Employees Process report

The employee process report refers to personnel processes; the employee process report can apply the employee's current settings via an option switch.

Options for calculating the monetary benefit

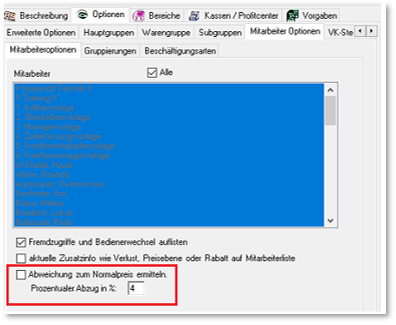

In special cases, e.g. if employees do not receive a special price level for their personnel bookings, but articles with discounts and different price levels are used in the normal business, the option button Determine deviation from normal price can be used. The value is then calculated from the discounts compared to the normal price (which the POS system also writes to the posting records - basic price in the journal). These results are used to analyse personnel price variances and can be used to calculate monetary benefits under certain circumstances. Percentage discounts can also be taken into account here (e.g. in Germany in 2017, 4% can reduce the amount for determining the non-cash benefit).

Example...

The operator is assigned the price level 50% staff discount for staff transactions (own consumption):

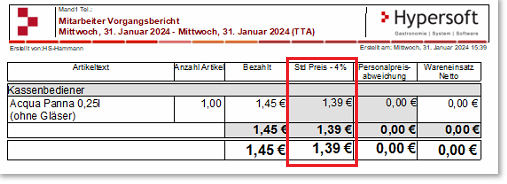

The option button Determine deviation from normal price deduction 4 % now results in different report displays.

Basis:

Item normal price : 2,90€

Item Staff discount 50% : 1,45€

Determine the example of the employee activity report and the setting for the variance to the normal price:

If the option Determine deviation from normal price is not used, the basis for the 4% deduction is the price level/discount as stored for the employee under payment information (in the example 50% staff discount ~ €1.45).

Sample reports

The inserts/extras of the booked items are printed in the form of a second line.

Example: small menu with the extras "Cola, Currywurst".

In special cases, for example, when employees do not receive a special price level for their personnel postings, but receive items via "discounts" and different price levels are used in normal business, you can use the Determine Variance to Normal Price option switch. The value is then calculated for the discounts in comparison to the normal price, which the POS system includes in the posting record (base price in the journal). These results are used to evaluate personnel price variances and can, under certain circumstances, be used to calculate the monetary value of benefits.

Here, percentage deductions can also be taken into account (in Germany, for example, 4% can reduce the sum in 2017 to determine a monetary advantage).

Please note that Hypersoft makes no statement about the treatment of any monetary advantage to your business. Discuss this with your tax advisor or payroll office.

Further topics:

Special price and loss treatment

If you give your employees customer cards, you can create an approximate evaluation using the special customer booking report: customer booking report

Further topics:

Employee transaction report (product groups)

Employees Detail activity report

Back to the overarching topic: E Employee evaluation