Dubai UAE Version

Master information and invoices

If the country selected is UAE, an input field will appear for 3 more "tax rates" which are derived from the contained VAT. can be pulled off. Example:

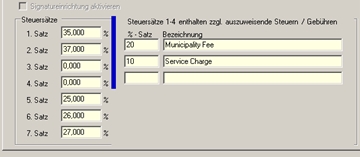

Service Charge and Municipality Fee are stored as special tax in the master data:

If a tax to be shown is deposited, it shall be shown on the invoice. Example:

VAT Rate 1 = 29% and tax to be shown at 10% results in 19% VAT. and 10% tax to be reported. Example of an invoice with tax totals shown as included and an example where the tax totals are shown as gross and net:

DIN A4 Forms

Support of the special tax printout on DIN A4 printer for Dubai. The corresponding variables can be found under "Footer.SpecialTax" in the Layouter.

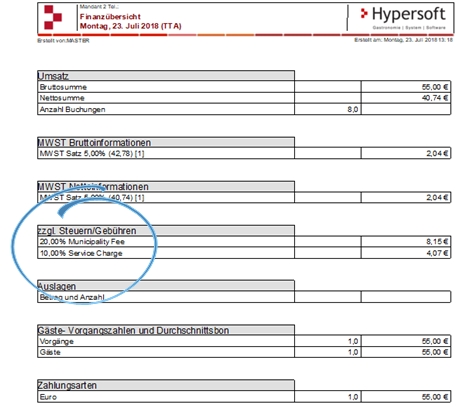

Report Manager Financial Report

The financial overview takes this into account as an evaluation.

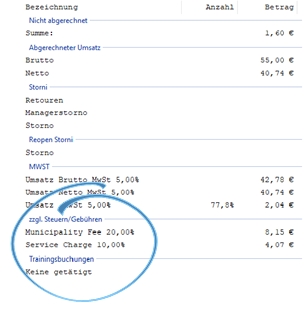

Front Office Financial Report

The financial report and the managers' report also show these values.

Back to the overarching topic: English and international version