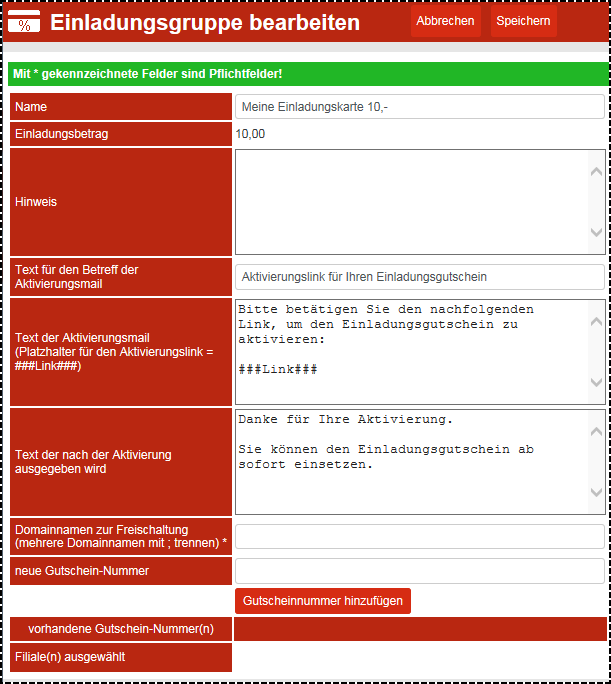

Web Vouchers Invitation Cards

The setup and operation of the elements is similar to that of discount cards, please refer to the instructions there.

Invitation cards receive a certain invitation amount. This amount can then be used for payment in the restaurant. Unlike previously paid-in amounts, no revaluation takes place here. There is also no amount of voucher revaluations in circulation.

The invitation amount can be used for payment at the POS system. If the payment amount is lower, the remainder of the invitation amount remains as voucher value. If you do not wish this, you can collect the voucher. If the payment amount is higher than the invitation amount, the payment amount is reduced by the amount of the invitation amount.

Treatment in the POS system

Offsetting entries are made in the POS system to reduce sales. The invitation amount of the voucher is divided up as a percentage of the bookings made. This calculates what percentage of bookings are 19% and what percentage are 7%, and the invitation amount is divided in this ratio. The invitation therefore reduces the VAT. Amount.

Comments on invitation cards

Clarify with your tax advisor the correct tax treatment of invitation cards.

Turnovers resulting from expenses or tips cannot be offset against the invitation amount. The amount of the invitation must be fully included in the taxable turnover.

Further topics:

Back to the overarching topic: Web Vouchers Special Cards