Set cash book

At the first call the settings should first be opened, checked and completed. You should then check the posting templates, sales tax rates, and any cost centers. After all settings and specifications have been checked, the first cash book can be created in the settings.

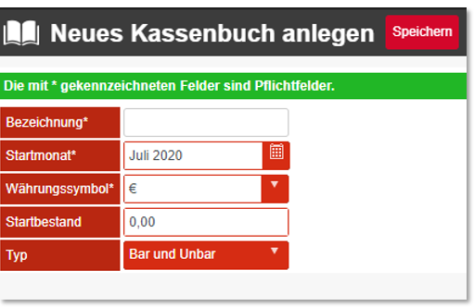

Select a starting month to be able to import all cash register data from then on (maximum possible back to January 2015). Please select the currency symbol appropriate to your POS system and enter the starting stock for the starting month.

Choose Cash and Non-cash to process and evaluate all postings in the cash journal or choose Cash to be able to use a cash journal legally compliant with German tax law.

Important remarks on the use of the cashbook: The BMF considers the former common practice in which cashbooks also record non-cash sales to be formally deficient. Depending on how you want to use the cash book in this respect, you can define a suitable usage type. Please consult your tax advisor if you have any questions regarding the handling you wish to choose.

The type of cash book is displayed in the cash book overview.

Change cash book type...

It is not possible to change the cash book for the cash closing entry as long as there are entries in it that have not yet been imported. You must first import all of them into the current cash book in order to be able to perform a type change afterwards.

Activate data transfer to the cash book

In the POS system, the portal clearing must now be set up for the connection to the cash book: To do this, start the MCP in the location and activate the Transfer of turnover data to the cash bookin the Front Office report settings.

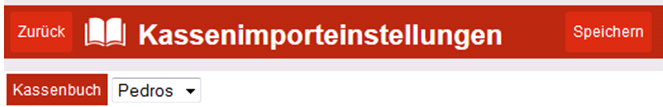

Cash balance import

Here a cash book is assigned to the import. The cash data is imported into the deposited cash book. It is to be noted that the deposited cash book reaches far enough into the past to allow an import of older data. During the first import (cash balance), cash data from the start date of the cash book is transferred.

The earliest possible date is 1.1.2015.

The change of the cash book takes place under the condition that already imported cash data remain in the previous cash book and cannot be transferred.

The cash book is designed to operate in your main currency (for example, the euro). It does not support currency changes in a current cash journal. There is also no multi-currency capability within the cash book. If you work with several currencies in the POS system (which is supported there), the amounts/totals are already transferred in the main currency according to your chosen conversion factors.

How to handle multiple currencies correctly is best clarified with your tax advisor.

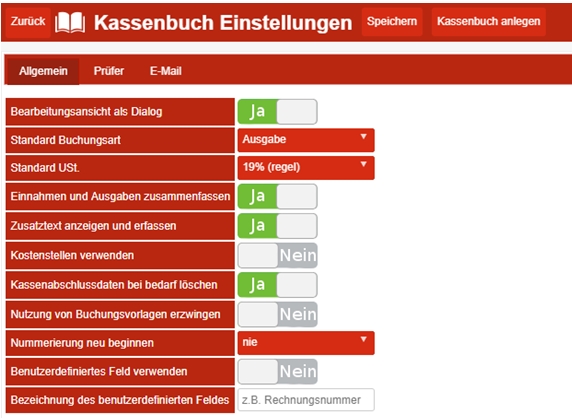

Settings General tab

| Element / Switch | Function / Description |

|---|---|

| Use cash book auditor |

An auditor is hereby assigned to the cash accounts. All fields must be filled in. The auditor receives a user account (e-mail and password) on the portal for the cash books. The cash book notifies the auditor automatically when cash books are handed over. If an examiner is deselected, the examiner's user account is deleted. All months handed over for examination will be retrieved for processing. |

| Personal data |

These are salutation, first name and surname of the examiner. |

| The email is the username to log in to the portal (the examiner can change it). | |

| password | The password is assigned by the user and is necessary for logging in to the portal. eMail and password must be communicated to the examiner in a secure way (the examiner can change this data). |

If an auditor is created in the cash book, the portal sends a mail to the auditor with the access data and the link to the documentation.

Hello, Mr. Mustermann,

a user has just been created for them, with access to the cash book of the company 'Company name'.

your access data for https://www.mobile-people.de are:

Username: XXX

Password: XXX

Under the following link you will find more information http://dokumentation.hypersoft.de/#html_hsportal/Kassenbuch_Pruefer.htm

Further topics: Guidance for Consultants

Settings Tab eMail

| Element / Switch | Function / Description |

|---|---|

| Notify users by email | The user will be notified via the email address provided. Notification takes place via the selection of 'Notification via'. |

| User eMail | The messages are sent to this e-mail address. |

| Notification about | Sends an email when the condition occurs. When a month goes back for correction by the examiner, or when a month is closed. |

| Notify examiner by email | Examiner is notified by email when a month is submitted for examination (examiner can change this). |

| Sender Name | The name of the sender of the notification e-mail. (Default: Cash book service) |

| Sender eMail | The email from the sender of the notification email. (default: noreply@hypersoft.de) |

The scope of possibilities of the functions is activated for the user on the basis of authorisations. The smallest authorization is the one for viewing. The authorization for editing is based on this and the editing of the settingsis based on this. The exception is the examiner authorisation, which differs from the other authorisations.

The following areas can be viewed:

- accounting templates

- cost centers

- VAT rates

- cash account books

Every month and its bookings can be viewed in the cash books. The year overview and the GoB Log can also be viewed.

The basis for this is the authorization to view. In addition, the cash statement can be imported and entries can be made in the cash books. A cash book month can be released for review, corrected and closed.

A cash register crash for the current day is possible.

The basis for this is the authorization to edit. In addition, cash books can be created and deleted, settings can be made and the history can be viewed. The settings also include the processing of posting templates, cost centers and sales tax rates.

The auditor has separate access to the cash book. He has his own settings that include his account to the portal. His inspection extends likewise over all months in the cash books and the annual overview and the GoB Log.

He may reset or close months submitted to him for review with a note for correction.

Back to the overarching topic: cash book