External sales

This function allows you to use Hypersoft POS to book items that are then taxed in another system. These can be postings to employees, for example, or other sales that are posted there after export to a subsequent system, for example. Since the turnover is external, it must then be taxed "there" as turnover.

If and to what extent this is compatible with the fiscal requirements in your country and location, please consult with your tax advisor and you should document it in your procedure description.

Further topics: Hypersoft procedure with external turnover

Create articles for external turnover

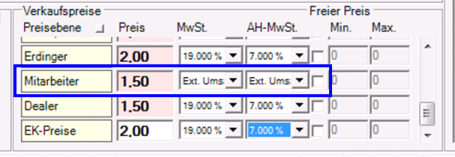

In this example, you want to ensure that all postings of the selected item are settled externally at the Employee price level, so you set VAT in the item master at the Employee price level. on Ext. Turnover.

Front Office Financial Report with External Turnover

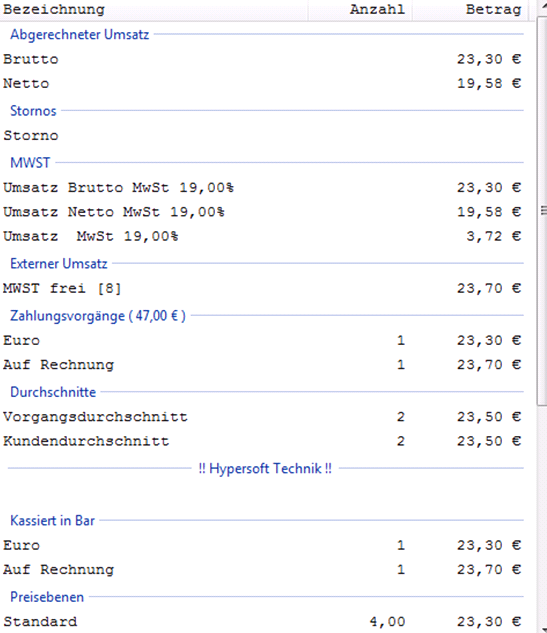

In this example, 23.70 was posted as external sales and settled to invoice. In addition, 23.30 "normal" to 19% were booked and settled in cash. Report 11:

Manager's Report (9)...

Operator overview (18)...

Operator accounting (17). Report 17 does not distinguish between gross and external turnover, so there is no differentiation there either...

Report Manager Financial Overview

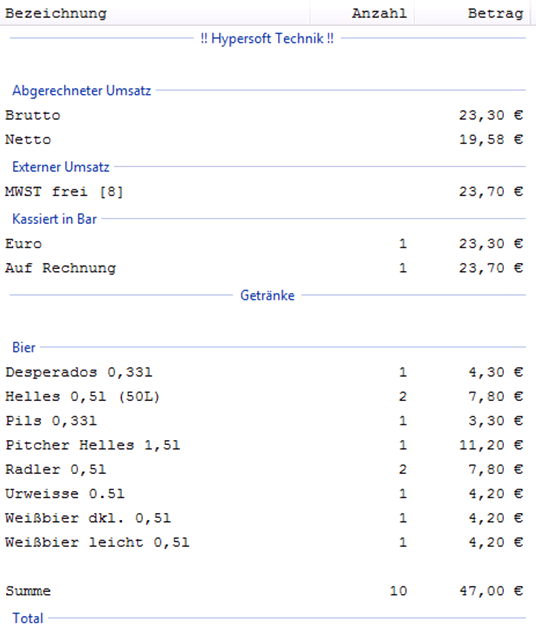

In this example, 23.70 euros were posted as external sales and settled on account. In addition, 23.30 euros were booked normally at 19% and settled in cash:

External turnover in export accounting

Via an option switch you can export external turnover in the financial accounting export.

Further topics: Including external sales

Back to the overarching topic: Booking items