The Financial Report (No.11)

This is the turnover report for the daily closing of your cash register system. Alternatively, you can use the compact financial report.

Structure of the financial report

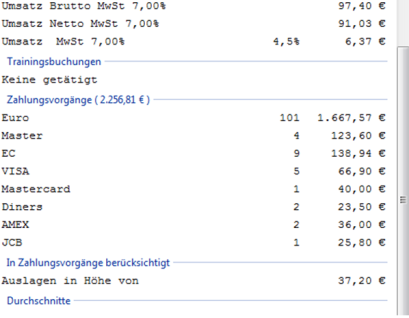

You can determine whether the individual payment methods should appear on the financial report and whether the sales should be highlighted. You can also specify whether the average should be printed per transaction or customer. The cancellations are listed according to use and settings.

The Return line shows the total of the postings that you posted using the Return cash function. Negative postings (negative item prices) are also displayed in the Sales Details area.

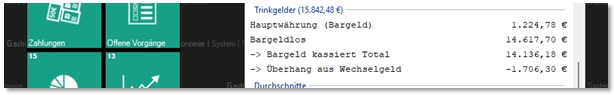

Tips in the financial report at the POS...

A separate section is shown in the POS financial report for tip bookings. This compares the total cash collected with the tips in cash and non-cash. In this way, the relationship between cash income and tips is shown transparently.

If the non-cash tips received exceed the cash income actually realised, a so-called tip surplus arises. In practice, this is usually settled from the change balance. The financial report itself does not assess whether the available change is sufficient for this. The change stock can be managed and controlled via Wallet Control if required.

Further topics:

Best practice: Cash shortage through cashless tips

The expenses are shown separately below the payment types in an extra group. There is an indication that the expenses have already been taken into account in the payment methods and that the total is only informative.

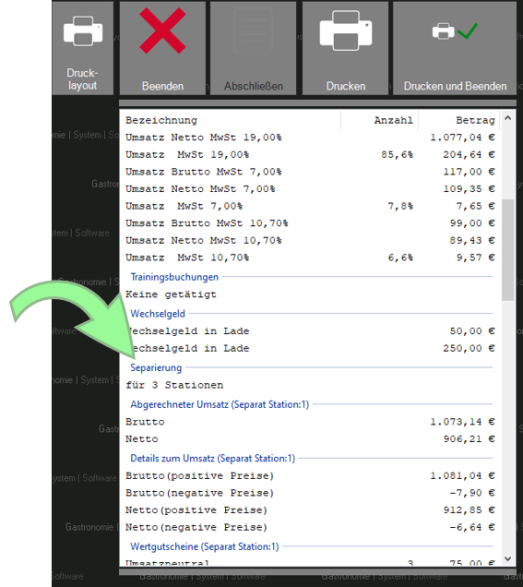

Separate across all cash registers...

With the switch Separate financial report for all funds..., if several cash registers are involved, separate evaluations are output after the cumulative evaluation according to the cash register stations involved. This is introduced with the section Separation and a note on how many wards the separation is for:

Tip information in the financial report

The expenses in the financial report are shown extended by the tip information in the case of tips, so that the tips are listed separately per payment type. The option Expenses in the financial report thus also activates this listing:

TSE defaults in the financial report

The report shows TSE failures, all TSE failures are listed by TSEID and time:

Further topics: KassenSichV TSE safety device

numbering

The numbering of the report allows you to control that all reports are submitted in full (Fraud Protection). They may also have this obligation to the following entities for tax reasons.

The financial report for a single station has a sequential number for each station. However, a networked system usually uses the reports with the option for all tills. This is a separate number range. Choose a method to get consistent sequential numbers on your reports.

Unfortunately, it can happen in practice that final reports are missing, since operators with the authorization to close the POS system embezzle a final statement. For example, after an early start of the day with completed transactions, a final report is simply created and the cash register starts with 0.00 sales from then on. Monitoring the continuous numbering helps you to take action against it.

If the turnover is used decisively to determine the taxable turnover, you must carefully keep the financial report, which is issued at the day-end closing, with your tax documents. However, this report does not suffice alone as proof according to GoBD/GDPdU.

Further topics: The financial report compact

Back to the overarching topic: Front Office Reporting