Post interim payments

Interim payments are payments in a transaction that does not complete the transaction but places a payment within the open transaction. Intermediate payments are initiated manually with the cash register function Intermediate payment or executed automatically if, for example, a web voucher is read in within an open process. Since this does not lead to the conclusion, several vouchers can also be used in one process. Intermediate payments can be made using any currency and also cashless payment methods. Vouchers can only be booked as an interim payment.

In addition, different payment methods with several intermediate payments can be used in one transaction: 10,-€ and 24$ and 35€ cashless by EC card etc.

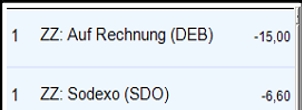

The interim payment is indicated within a transaction by "ZZ: Payment type". POS transaction list view:

Intermediate payments with vouchers

If you pay with a voucher from the voucher management or a web voucher, a process must be open and the voucher is scanned in the standard with a scanner. The amount required for the payment will be offset as far as possible from the credit balance of the voucher with the payment amount.

In the multi-payment function, a voucher can be accepted by scanning or barcode / voucher key. If the credit balance of the voucher is sufficient, the process is also closed immediately.

With the cash register function barcode you can also enter the number behind the code manually.

For Yovite vouchers you will be asked to enter the voucher number and then the voucher pin.

Further topics: Web voucher All

To be on the safe side, you should also check redeemed vouchers from the voucher management and, if necessary, cancel them. A barcode is easier to copy or replicate than banknotes and the barcodes could be easily calculated or guessed. You may also use special gift cards to stick coupons in or special paper, stamps or signatures to increase copy protection. When using web vouchers, you have a much higher level of security, as the codes can hardly be calculated or guessed in practice. In the further understanding customers are accustomed not to handle codes carelessly, since almost all standard tickets can be copied theoretically, but can only be used once. In the case of misuse of illegally copied web vouchers, this can be proven in the history (there is no known practical example of misuse).

Reversing payments with vouchers

If you reopen or revise a transaction that was paid for with a Hypersoft web voucher, the amount paid can be credited back to the credit of the web voucher. To do this, you must reverse the interim payment from the posting list:

If (foreign) 3rd party web vouchers are used, this possibility does not exist. It is possible to create a Hypersoft voucher for the equivalent value for the customer or, for example, book a BAR payout.

A voucher sale can be undone with the cash register function Retour. The daily turnover or income amount is thereby reduced by the value of the voucher, the payment method with which the voucher is paid out again (e.g. BAR) is reduced.

The voucher is thus safely cancelled, it can no longer be redeemed.

Payments with Hypersoft and 3rd party vouchers

There are certain cash register functions for third-party vouchers. The cash register function External voucher balance displays the credit balance of the external voucher (if supported by the external system). After activating the function, you will be asked for the voucher number, which can also be scanned. The credit is displayed below. The cash register function Use external voucher debits the open amount of the transaction as far as possible as a partial payment from the voucher.

If the foreign voucher key is on the keyboard or in the side panel, the foreign voucher key is also displayed in the multi-payment dialogue.

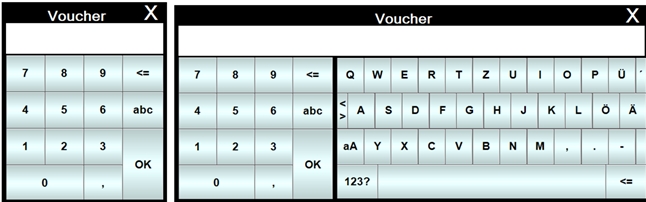

By clicking on Use external vouchers, a dialog for a numerical search appears. The abc key can be used to extend this to alphanumeric search.

Interim payment for external standard vouchers

In this example, an interim payment is made with a fixed voucher amount (here 0.50 of the main currency). For this purpose, a payment method voucher (+) must have been set up in the currency table.

Intermediate payment + 0,50 payment method voucher.

You can enter the number in advance as a multiplier in the usual way, for example: 4 x... You can also enter a flexible value for the voucher. Example: Enter amount.... and then 1. Interim payment 2. Your payment voucher.

The examples can also be used for interim payments with the main currency or another currency. If you use a different currency, this must be set up as the currency in the currency table.

Special regulation: change on voucher

You can spend money on the acceptance of vouchers. If you do not wish this, set up an additional payment type : overpayment voucher (-) (the payment type does not have to be set up and used in cashier mode, it is sufficient to set up in the currency table).

This means that surpluses from voucher payments are transferred to this payment category (and the associated payment type) and cannot therefore be paid out as a change.

On forms and operator reports, you receive information about payment methods and change, provided you have activated these options in the form settings. You must issue a payment report for your daily closing.

The interim payment function must always be the first function in a macro (if you want to prevent the accidental transfer of values with C-deletions, place C-deletions in the second place).

Retrieve voucher information

You can display the information of the vouchers and web vouchers from the cashier mode. Use the cash register function Voucher Info.

For Yovite vouchers, use the WEB Voucher Balancefunction.

For third-party vouchers, use the cash register function Third-party voucher balance.

Further topics:

Back to the overarching topic: payments