2. initialization and commissioning

The signature creation device is connected via the USB port of the server or the main cash register.

Please make sure that the USB signature creation device is not (accidentally) removed from the server/the main cash register, as it does not differ from a standard USB stick at first glance.

To put the signature creation device into operation, please download the driver from the following link and install it:

http://www.a-trust.at/ATrust/Downloads.aspx

Alternatively, it is stored for you on your POS server (from SP85) in the folder C:\Hypers-!\AddOn\Smartcard under the file name: ASignClient.exe.

Alternative setup of signing as a service

We would like to point out in advance that you can also set up signing as a service. This is indicated if the signing is performed on a server (or device) which is also accessed via RDP. The setup as a service then ensures that the signing is not terminated. If this is not the case, do not necessarily set up the signing as a service and continue with the next chapter.

Set up signing as a service...

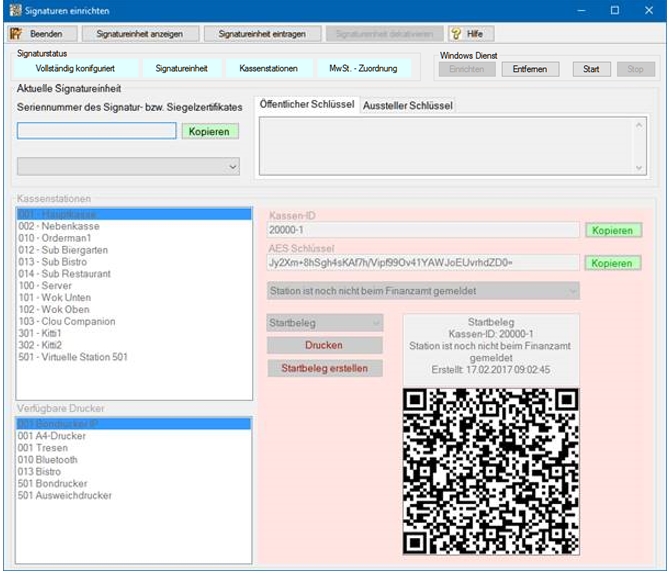

In the upper right area there is a section Windows Service.

There you can set up the function as a service and start/stop accordingly.

The buttons are active / inactive depending on the possible function.

The start / stop and manage of services is managed automatically.

After the first setup, the service must be started by pressing Setup (if it is to be used immediately, e.g. for a first setup in an RDP session).

Setting Up Hypersoft Software

Please read this chapter completely before making any adjustments to the control sets.

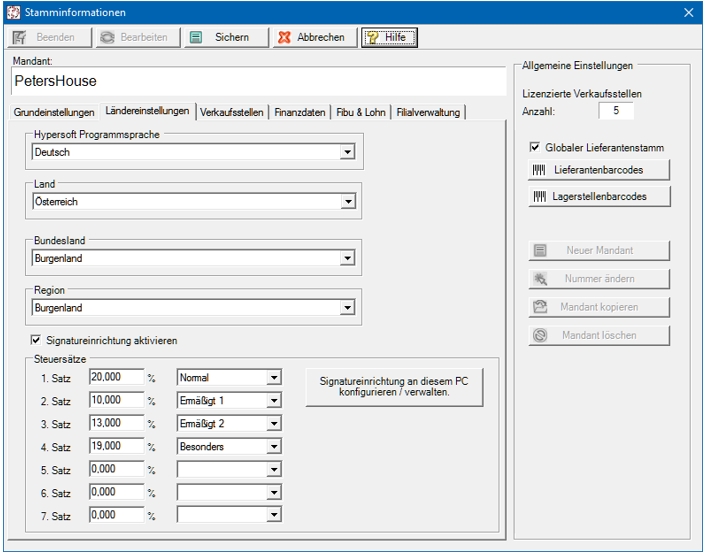

In the MCP, the master information program in the RegionalSettings tab is used to set up the system: Operational country settings

Set the country to Austria if your company is in Austria.

If your company is located in Germany, but you want to work in Austria across borders, then you should hire Germany as your country and make all other settings as described in the entire Fiscal Law Austria section.

Please click on the Activate Signature Device button (with Austria this is activated automatically).

In Austria, there are four fixed tax rates (status 03/2017) which are required for the signature creation device. Please create them in consultation with your tax advisor as follows (to make the changes, please click the Editbutton first).

- Normal 20% VAT (standard tax rate)

- Reduced 1 10% VAT (e.g. favoured food and beverages)

- Reduced 2 13% VAT (including accommodation)

- Especially 19% VAT (rarely used for Special)

You must use all four categories once and the order of tax rates is arbitrary. If you have an existing system, make only the most necessary changes (select the categories and add missing tax rates). Also make sure that if you have VAT. Blocks used with 0 (zero) did not inadvertently change them). It is essential that they do not make unnecessary changes to VAT. Sentences, since these are linked to items by reference. By referencing, you can make adjustments to the value assigned to the respective tax rate in the event of tax changes (note: the posting journal securely stores the rate used with and at the time of the posting).

The Configure Signature Setup button on this PC takes you to the Hypersoft interface for managing the POS and signature creation device. This dialog, which must be started at the server main cash desk or at the station with the signature device, is used for the final setup.

At the first start only the signature creation device can be set up, the area of the stations remains deactivated. You can add a new signature creation device or display the existing signature creation device using the two buttons: Enter Signature Device or DisplaySignature Device.

Note: The unit may expire (after 5 years) or a defect may occur so that these settings must be renewed from here.

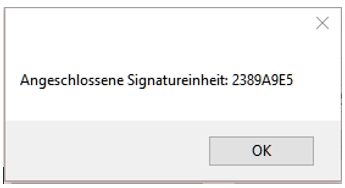

Please confirm Show Signature Device to ensure that your signature creation device has been installed correctly. A dialog with similar content is displayed for confirmation:

If you see the number of your signature creation device as shown in the previous screenshot, you have successfully connected the signature creation device.

When attempting to disable the signature device, the system first checks whether signed data is available. If data is available, the shutdown is not executed. For security reasons, deactivation is only possible if the signature has not yet been in operation. For security reasons, this cannot be influenced by changing the country setting.

You can also select and print the annual receipt and the corresponding year directly here.

-

The annual voucher is automatically generated with the first posting from 1 January. of the new year. If the cash register has not yet posted in the new year, there will therefore be no start voucher.

-

The annual receipt is generated per cash register

-

The annual receipt is not automatically printed or transmitted. Transmission to the responsible tax office is done manually (scan, copy and send by e-mail, etc.)

Annual vouchers can also be created after March in debug mode (note for support: if a closing voucher was forgotten to be created during decommissioning).

Special feature A4 Mail invoices or invoices

For information on how to adapt the layout in this context, see Special layouts for the Austrian Cash Register Ordinance.

Further topics: 3. registration via FinanzOnline

Back to the overarching topic: Fiscal Law in Austria RKSV