Hypersoft procedure for vouchers

The Hypersoft system supports 3rd party voucher systems in addition to its own web voucher system (online) and classic voucher management (offline). 3rd party voucher systems are usually used exclusively for payment.

If 3rd party systems are to be topped up, we refer in the standard to payment terminals, which are available from special payment terminal providers depending on the 3rd party voucher provider. Thus, these 3rd party top-ups are a standard payment for payment terminals for us.

that it can be used across locations. Constellations in which different owners and companies work together within a system are also supported. For this purpose, the system can evaluate the revaluation and devaluation of the vouchers in such a way that the companies can easily and amicably settle these situations among themselves.

Further topics:

The voucher (offline) management

Single-purpose and multi-purpose vouchers with exhibition as of 01.01.2019

No tax or legal advice

The following information is for general guidance only and does not constitute tax or legal advice.

Hypersoft is not authorised to do this.

Please check the contents carefully and, if necessary, consult with your tax advisor or another competent person to ensure that your approach complies with the applicable legal and tax requirements.

If necessary, adapt our advice to your individual circumstances and record the results in your procedural documentation.

In Germany (but you in other parts of the EU) applies:

Please note the new regulations for vouchers issued from 01.01.2019. The new distinction between single-purpose and multi-purpose vouchers replaces the previous regulation of value and goods vouchers.

See §3 Abs. 13-15 UStG https://www.gesetze-im-internet.de/ustg_1980/__3.html

Single-purpose vouchers:

Single-purpose vouchers are characterised by the fact that they already contain all information relevant to turnover tax at the time of sale, such as the place of performance and the tax rate to be applied to the performance on which the voucher is based. The date on which the voucher is issued is already regarded as the date of taxation for value-added tax. The voucher issue is virtually the performance. This means that in the case of single-purpose vouchers with the issue of the voucher for money, the taxation of the (possibly later) service is already shifted to the time of issue (possibly earlier). The (possibly later) redemption is no longer a controllable transaction. If a single-purpose voucher is not redeemed, it is still subject to VAT at the time of issue and there is no retroactive offsetting or crediting.

It is not possible to separate the sales tax to be paid from the posting of the sales, as is the case, for example, with the sale of New Year's Eve cards.

Multi-purpose vouchers...

Multi-purpose vouchers do not have the clarity of single-purpose vouchers, which is why turnover taxation only takes place at the time when the service is actually provided. It is therefore unclear at the time the voucher is issued where the turnover is generated and to what extent VAT is incurred. The issue of a multi-purpose voucher is therefore only the exchange of money for "voucher money". If a multi-purpose voucher is not redeemed, there is no turnover tax.

Exceptions:

Discount vouchers which grant a price reduction are currently excluded from the new regulation, as these do not entitle the holder to the service, but merely reduce the basis of assessment. Also not included are stamps or tickets for theatre, cinema and museum.

The standard vouchers can be set up as both single-purpose and multi-purpose vouchers.

The MOBILE PEOPLE web vouchers are exclusively multi-purpose vouchers, as neither the location nor the service are defined before they are redeemed.

Examples...

An item voucher from voucher management that represents a defined service is a single-purpose voucher.

A web voucher can currently only be used as a multi-purpose voucher, as the system in the credit management no VAT. is supported. They must therefore use this system to monitor and fulfil the tax criteria of a multi-purpose voucher.

In order to meet the criteria for a multi-purpose voucher, several conditions must be met at the same time, in addition, you should coordinate the use as a multi-purpose voucher with your tax advisor. A multi-purpose voucher could be appropriate if it represents an amount of money and it is not clear at the time of sale where it will be redeemed or what VAT will be charged. rate is applied to the sale (if you offer food inside or outside the house, or postcards, for example). There must be no other restrictions on this single "or". This may already be the case through limited validity on certain days or through early expiration of any kind. (Note: Web vouchers currently only support the multi-purpose voucher type).

The use of the voucher

If a voucher is scanned, entered via the checkout barcode function or entered and applied via an eSolutions system, it is included in the process and used. Example mPOS:

Treatment of revenue-neutral vouchers from a fiscal perspective

Treatment of revenue-neutral web vouchers...

The sale (charging):

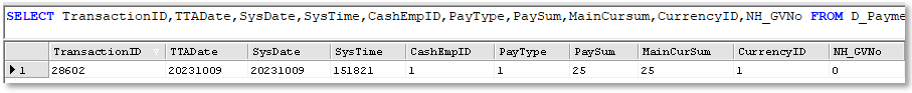

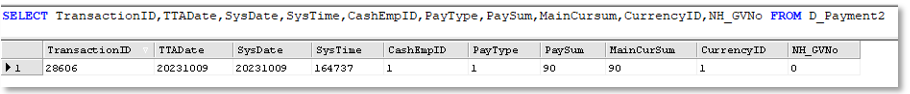

In the payment database, the revenue is registered as a normal sale. In this case in CASH.

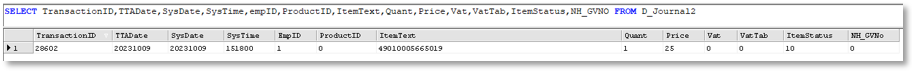

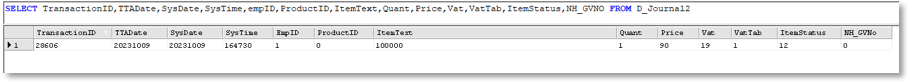

A record is inserted in the journal for each voucher sold. The item text contains the voucher number. Since the voucher is treated as revenue neutral, Vat, VatTab is set to 0. ItemStatus contains a 10, so the neutral voucher sale is identified. The price is in the Price field.

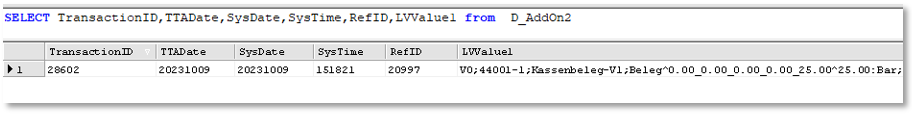

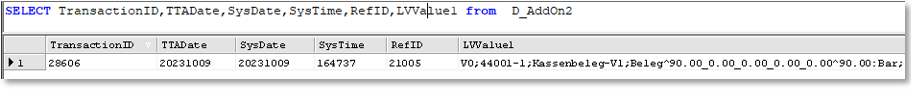

In the AddOn table, the signature for this sale is saved. At the 5. VAT rate (0%) is the sum of the sale registered:

Journal records:

The voucher is given a record in the journal purely for information purposes to represent the information about the use of a voucher in this transaction. The ItemText contains the booked amount for this voucher (S:8,5). ID of the voucher in the card database (Z:16):

Payment:

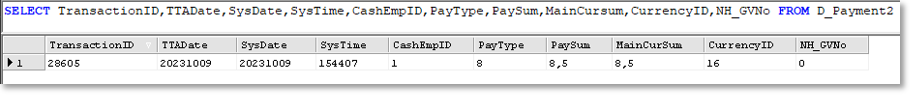

Here you get PayType 8 (voucher) and the sum of the linked CurrencyID from the currency table (16):

AddOn Table: The Signing

The total amount of the transaction is split based on the tax rates included. As the payment was made by turnover-neutral voucher, the counter entry is offset from the 5th VAT rate. As neither cash nor non-cash money flows, there is no means of payment in the signing.

Treatment of single-purpose vouchers from a fiscal perspective

Example of fiscal treatment based on bonus offline vouchers from the Voucher Management...

The sale (charging):

In the payment database, the revenue is registered as a normal sale. In this case in CASH.

A record is inserted in the journal for each voucher sold. The item text contains the voucher number. Since the voucher is treated as a single-purpose voucher, Vat, VatTab is set to 19 and 1. ItemStatus contains a 12, so the single-purpose voucher sale is identified. The price is in the Price field.

In the AddOn table, the signature for this sale is saved. Under the 1st VAT rate (19%) the total of the sale is registered. The sale was made in CASH:

Journal records:

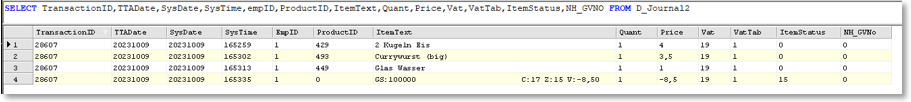

As this is a single-purpose voucher that has already been taxed, an offsetting entry is made in the journal when the voucher is used with the VAT status(VAT Tab) used in the original sale and the current associated VAT rate. The ItemText contains the voucher number, the amount booked for this voucher (V:-8,50), the ID of the voucher from the card database (C:17) and the payment method used from the currency table for the voucher (Z15).

Payment:

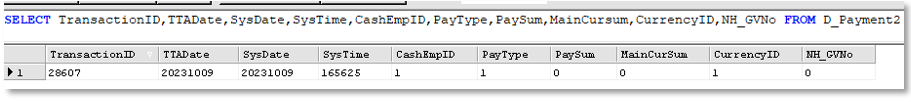

The payment is in the payment database with 0 euros, as no money has flowed in this transaction. The offset is made with the voucher that was already taxed at the time of sale:

AddOn Table: The Signing

The signature is also 0, as the voucher was taxed when it was sold:

Back to the overarching topic: Fiscal Law on the Application Decree on Section 146a AO