Credit from web vouchers with validity

By optionally setting a validity period for the credit balance of web vouchers, you can save on the payment of VAT by not redeeming the voucher and write off the amount after the period you have specified. To use this function, we strongly recommend that you seek advice from your tax advisor in accordance with the legal requirements. In addition to the legal requirements, please also consider the view of your users regarding a possible cancellation of the existing credit and the possible dissatisfaction or disappointment associated with this. As you can also define the validity longer than the legal requirements, both views can be combined under certain circumstances. Web vouchers are tax-free due to the system (multi-purpose vouchers), any restriction of a voucher can lead to it being regarded as a single-purpose voucher for tax purposes.

Hypersoft procedure for vouchers Further topics:

No tax or legal advice

The following information is for general guidance only and does not constitute tax or legal advice.

Hypersoft is not authorised to do this.

Please check the contents carefully and, if necessary, consult with your tax advisor or another competent person to ensure that your approach complies with the applicable legal and tax requirements.

If necessary, adapt our advice to your individual circumstances and record the results in your procedural documentation.

Functionality of validity

In the web voucher settings, you can specify a validity period in years and an annual date for cancelling expired vouchers. Credit balances of vouchers that have neither been loaded nor unloaded for the specified period of validity and for which the corresponding cancellation date has been reached are automatically cancelled and reset to a credit balance of 0. This derecognition takes place according to the location(s) at which the credit was topped up and always relates to the entire credit balance of the voucher. A query of the credit without simultaneous charging or discharging does not extend the validity. Derecognition takes place automatically every year on the date stored in the portal. If desired, the date can be adjusted to allow multiple cancellations per year.

Defining the validity and derecognition in the portal

In the central settings of the web vouchers, the annually recurring date (day/month) of cancellation and the number of years of validity of the credit can be defined. In this example, the vouchers are valid for 3 years with an annual expiry date of 15 November. to /TTA:

Please note the following special features of the derecognition run...

The derecognition run takes place on the day of the date set for the TTA (at 06:00 in the standard system). Example: If you store a derecognition on 1 December, the derecognition takes place on 1 December. at 06:00 and thus for the opening day of 30.11. Only the available credit is cancelled, all other features such as discounts or collected bonus points remain with the voucher. The web voucher is not blocked if it is cancelled, but remains in active status. After a cancellation, the voucher can be topped up and used (as before).

Definition and view of write-offs

Web vouchers with a credit balance that have exceeded the stored validity period are checked on the date set each year and the credit balance is cancelled if necessary. The charge-off is always made to the total amount available and to the respective top-up locations. The rule here is that credit that has been topped up first is used first when redeeming. In the following example, two web vouchers were topped up with an amount of €75 and €50:

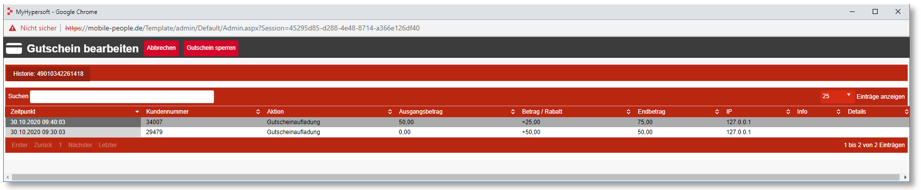

Web voucher 1 was topped up by 2 shops with 50,- and 25,- over 3 years ago:

Web voucher 2 was topped up with 50 and not used for 3 years:

After the write-off run, the following entries were added to the history of the web vouchers for write-off:

Voucher 1:

Voucher 2:

Settlement of derecognisations

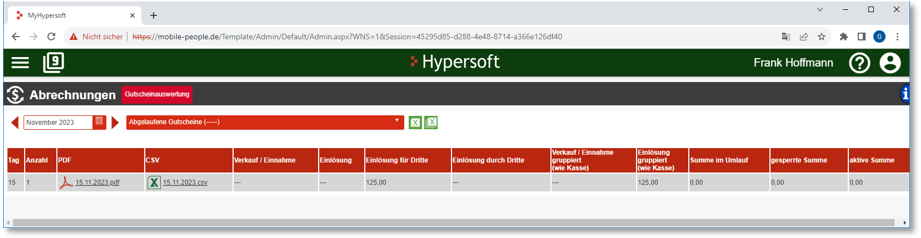

The billing overview contains an "additional shop" labelled Expired vouchers. All bookings can be analysed across all locations via this new "branch":

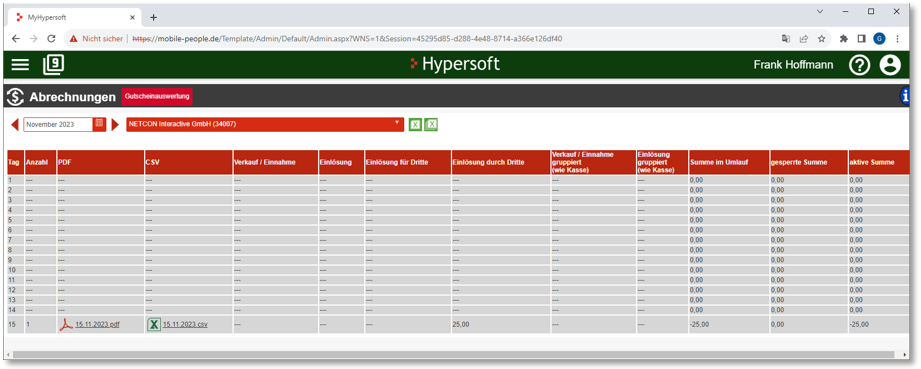

All other branches will also have the write-offs for their respective location included in the statements on 15 November 2023 (for the write-off run):

The cancellations can therefore either be tracked in each location statement or collected under the "Store" Expired vouchers". Example of billing for the "shop" Expired vouchers with the above-mentioned vouchers. vouchers:

A total of 125 were booked. The report also shows which amount is due to which location. The derecognition is labelled as a redemption for third parties.

The statements for the individual locations only contain the relevant write-offs for that location:

The CSV files also provide information on the respective voucher numbers that have been booked:

Web vouchers with validity from the user's perspective

If you use the external interface or landing page of the web vouchers on your homepage, in which your users can query the current balance and the history of your web vouchers, the cancellation will be displayed as a cancellation in connection with the respective amount.

Accounting for web vouchers Further topics:

Back to the overarching topic: Web-Vouchers