Tipping with eSolutions

No tax or legal advice

The following information is for general guidance only and does not constitute tax or legal advice.

Hypersoft is not authorised to do this.

Please check the contents carefully and, if necessary, consult with your tax advisor or another competent person to ensure that your approach complies with the applicable legal and tax requirements.

If necessary, adapt our advice to your individual circumstances and record the results in your procedural documentation.

Basic idea

eSolutions are a central component of your digital business success. Integrated processes should always take your employees' interests into account - especially when it comes to tips.

Tips are an important part of everyday service and can - under certain conditions - remain tax-free. It is therefore crucial to address this issue and integrate the relevant processes correctly into the company.

Introduction: eSolutions and tax-free tips

Tips are not automatically tax-free.

Certain conditions must be met for tax exemption - in particular direct interaction between the tip giver and the recipient.

This is not always the case with eSolutions.

Examples:

A) An online order with parcel delivery generally does not include a tax-free tip, as there is no direct encounter.

B) An in-house order, where a service employee brings and collects the order, can allow tax-free tipping.

C) Mixed forms between A and B require an individual assessment.

Ideally, create a workflow concept and coordinate your rules with your tax advisor.

Technical basis for tip configuration

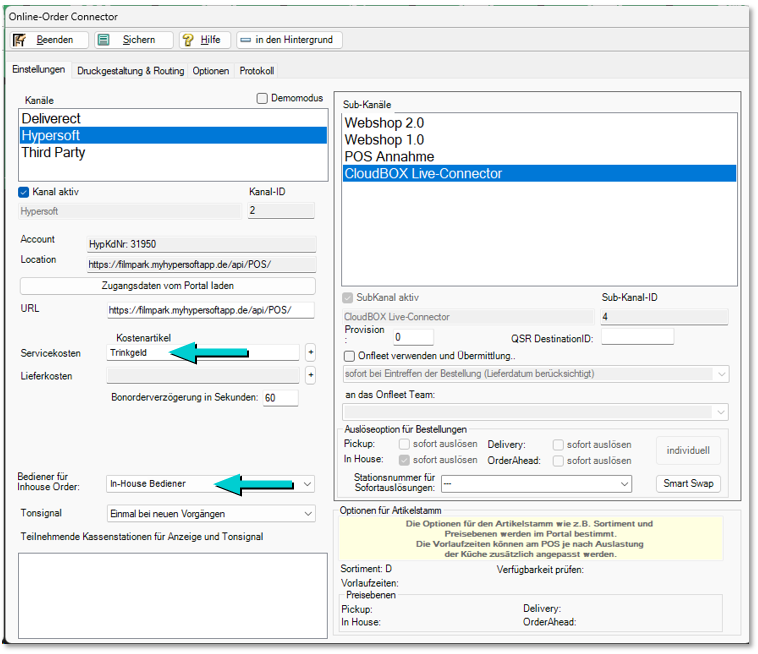

The service costs are set in the main Hypersoft channel and affect both the web shop and the in-house order.

In-House Order: Definition of the tip

A tip item can be used in the Hypersoft standard, which is treated as a tax-free tip when booked at the POS.

Alternatively, you can create a separate item that is taxed regularly (this must not be called "tip", as this term could be automatically treated as tax-free).

For details, see The tax-free tip item and The taxed tip item.

In the case of in-house orders and in-house group orders, the transaction status determines the tax treatment of the tip:

Case 1 - No process responsibility

As long as no operator has opened and closed the process, there is no process responsibility.

If a tip is booked in this case, the system uses the article stored in the Online Order Connector in the service costs (tip) area.

This can either be the tax-free POS tip item or another taxed item.

Case 2 - With process responsibility

As soon as an operator has opened and closed the process once, they assume responsibility for the process.

If a tip is then posted, the tax-free tip article of the POS system is automatically used - regardless of which article is stored in the connector.

This gives you the option of taxing in-house order tips without transaction responsibility or treating them as tax-free.

However, as soon as there is an operator responsibility, the tax-free tip item is always used.

Technical restriction

There is currently no technical option to post tips for transactions with operator responsibility as taxed.

Any taxation must take place outside the Hypersoft system.

As the service costs are defined in the main channel, this rule applies equally to webshop orders and in-house orders without process responsibility.

Tipping the operator (in-house)

For in-house orders without transaction responsibility, the tip is assigned to the operator defined in the Operator for in-house orders section of the Online Order Connector.

It is recommended to create a virtual operator (e.g. in-house order group) for this purpose. Tips from these transactions are then collected under this operator and can be analysed. The mostly cashless tips from this area are intended to benefit the actual service staff. In practice, this tip should therefore be paid in cash to the service staff.

Further topics: Best practice: Cash shortage through cashless tips

The specific implementation depends on your tax coordination and should be documented in your process description.

An exception is the NoCOO Online Payment Tip.

As it can be paid in direct contact between the guest and the service employee, it can be treated as tax-free - provided that all requirements are met.

Service costs in the webshop

For webshop channels where no service is provided (e.g. shipping orders), no acceptance of tips or service costs should be activated. Otherwise, the tip would generally be taxable.

Conclusion

Hypersoft's eSolutions tipping system enables flexible but legally compliant handling of tips - taking into account the respective transaction type.

-

Automatic allocation of the tip logic

-

Tax-compliant treatment depending on operator responsibility

-

Clear rules for in-house and webshop orders

Set up your processes together with your tax consultant so that all cases are correctly mapped - for satisfied guests, fair employee remuneration and legal security.

Further topics: Tip functions

Back to the overarching topic: Hypersoft POS Cash Handling