Tip functions

A tip is a voluntary payment made by the buyer or customer to the employee of a service provider, in the case of services received, in excess of the purchase price or as a separate payment. The voluntary tip must be separated from the service charge or service charge, which forms part of the purchase price.

Tip functions should be trained with staff and included in the procedural description of your accounting system.

Tax on tips or not?

Tips cannot be booked even from 2020 onwards with the German cash register regulation, if this is kept separate from the turnover. You as the operator are responsible for the separation. In the case of cashless transactions, the operator would have to immediately remove and separate the (tax-free) cashless tip in cash.

As a proprietor you have to pay sales tax on your tips in any case and can create a normal item for booking or do without tips altogether. The tax liability can already result from the fact that the "third party" does not hand over the tip directly to the person who provided the service for him. Tips should also be local and should only be paid in "appropriate amounts" in order not to become taxable.

We assume that you with our accounting possibilities to give unnecessary taxation of tips for employees to avoid. Collecting and splitting tips and cashless tips are special challenges. In this context, cashless tips, which are indeed collected through your account, can also become critical.

The Federal Fiscal Court (for Germany) has issued an exonerating clarifying ruling (18.6.2015, VI R 37/14).

To what extent tax-free concepts through fiduciary administration or immediate accounting with server accounting are tax-fair for you is best discussed with your tax advisor. In the Hypersoft POS system there is the possibility to set up tips in such a way that you need them for the correct and fiscally correct treatment in the respective case.

If you work with a webshop or other connected eSolutions and do not have a concept for tax-free tips, you must pay tax on the tips.

No tax or legal advice

The following information is for general guidance only and does not constitute tax or legal advice.

Hypersoft is not authorised to do this.

Please check the contents carefully and, if necessary, consult with your tax advisor or another competent person to ensure that your approach complies with the applicable legal and tax requirements.

If necessary, adapt our advice to your individual circumstances and record the results in your procedural documentation.

If you book cashless tips exclusively with the card payment via an EC credit card terminal and have not created the tip article, then this will be created by the system. However, the tip entries made are then displayed on the commodity group reports as "without allocation". Therefore, you should define the tipping item as described below:

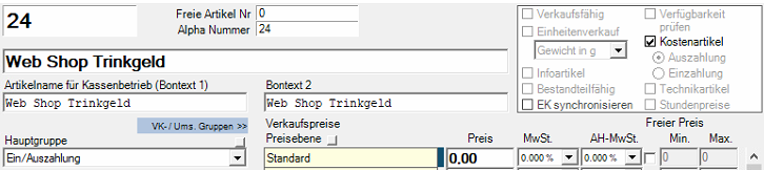

If you want to book additional tips, you must create at least one tax-free tip item:

- Set up an item called TRINKGELD. Use large letters for emphasis and make sure to start the item with the text TIP (in the German version use TRINKGELD). After this name you can enter a space and further text, also to enter several different tipping items, example: TRINKGELD employee 1 and TRINKGELD employee 2.

- Activate free price entry for this item (exception: all operators, even operators without the authorization for free price entry, can book free prices with this item). To avoid incorrect entries, you can limit the free price entry by using the field Maximum (also minimum).

- Turn off the VAT for this item.

- Let the operators enter an amount as a free price and book this item.

If you create an item as a tax-exempt item as described here, and you pay VAT on the item. is activated, this setting of the VAT not used for this item!

Simply use any item, which is booked and evaluated like all others. There are possibilities to sort items and highlight them in evaluations. Do not call the item TRINKGELD or TIP (as described above), otherwise functions may be triggered unintentionally, also the item text must not contain these terms, otherwise the system will activate the tax-free treatment. For example, use Service payment.

The tip item should be set up with the following options:

- The item must NOT start with "Tip" or "Trinkgeld" (but it can be called "Webshop Tip", for example).

- The item must be declared as a cost item.

- The item must have VAT 7%, 19% or 0%, not display. Whether 7%, 19% or 0% must be clarified with your tax advisor.

- You can declare the item as not saleable in the item masterif it is only used in the webshop, for example, and so that it does not "interfere" with the normal cost items.

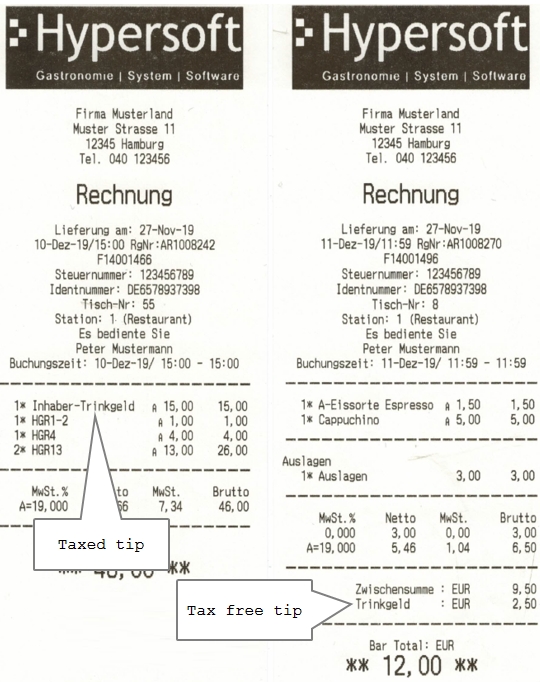

Tipping on forms

Taxed tip is with the other item bookings. Tax-free tips are shown separately on the bills below.

Tipping items that are taxed "normally" appear on the invoice with all other items and can be sorted between the other bookings using the sorting function. However, most of the special Hypersoft functions and automatisms only book tax-free tips.

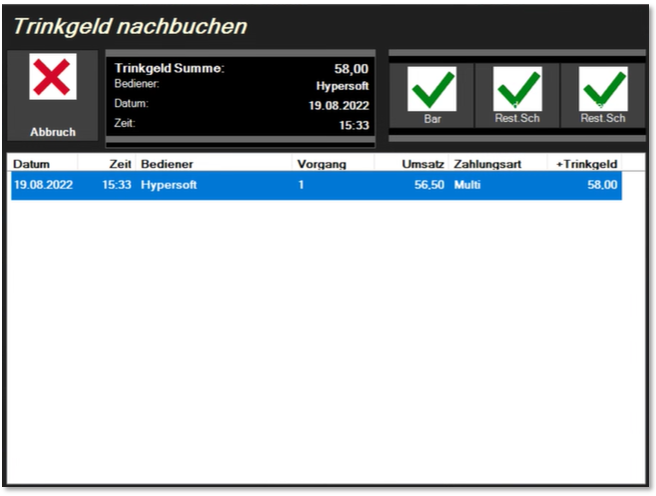

Generally, a warning may appear at the POS if the tax-free tip amount exceeds the amount of the transaction to be paid. You can use this function to post tips to activities that have already been completed. This function is particularly powerful in connection with our cashless payment transactions, since card payments can be increased even without re-reading the card (technically, the re-reading of cards is not necessary for most procedures - legally, the necessity depends on the regulations of the card companies. If necessary, check whether you may use this function without re-reading the card).

Position the tip function on the keyboard afterwards.

Enter the amount of the tip (example with 24,-) as follows:

- /number pad 2 + number pad 4 + tip later.

- A dialog appears which displays the actions of the current operator sorted by time of completion. (If you have manager status, the operations of all operators are displayed.)

- You will see the tip amount (in our example the 24,-), which is to be added, as well as the respective transaction amount with and without the tip amount - for faster orientation.

- Select the desired transaction and confirm the desired payment type. For this purpose, up to three payment methods are available to them at the top right (based on the payment methods used in the transaction and always also a button for cash payment).

- A new receipt is now created for ec or credit card payments, but not for other payment methods.

This is a quick and convenient procedure. However, please note that this tip is booked tax-free in the standard. If you post tips on payments and, for example, more than one of the guests has used this payment method, no direct relationship can be seen in the data (this is important for tax exemption in Germany, for example). Generally, of course, the dialogue does not automatically book the payment to the corresponding items of the payer. To be on the safe side, the data should always reflect what happens in practice. Thus, it would be better to split an invoice per payer and enter the respective tip accordingly.

Further topics:

Arbeiten am DON/MAX - Trinkgeld buchen

Process transactions involving non-cash payments

POS with cash register function Book remaining amount as tip

With the cash register function Book balance as tipoverpayment can be booked as a tip. By default, the function is used in the macros of the closing keys. If the transaction total is e.g. 37,- and the customer gives 40,- including tip, then the operator posts 4 + 0 and then the closing key. The 3,- balance is automatically booked as tip.

If you work with payment terminals, the tip is requested directly at the terminal for terminals from the programme, for example Hypersoft Pay powered by Adyen. However, if a guest asks you to book the tip (as in the example with 37,- "make it 40,-"), then you book 4 + 0 + cash function balance is tip (this time as a single function on the keyboard) in the open transaction and then press your standard cashless close key. The terminal then already displays 40,-, the customer can skip the question about a tip and pay immediately without cash. The cash register system also books 3,- as a tip after successful payment.

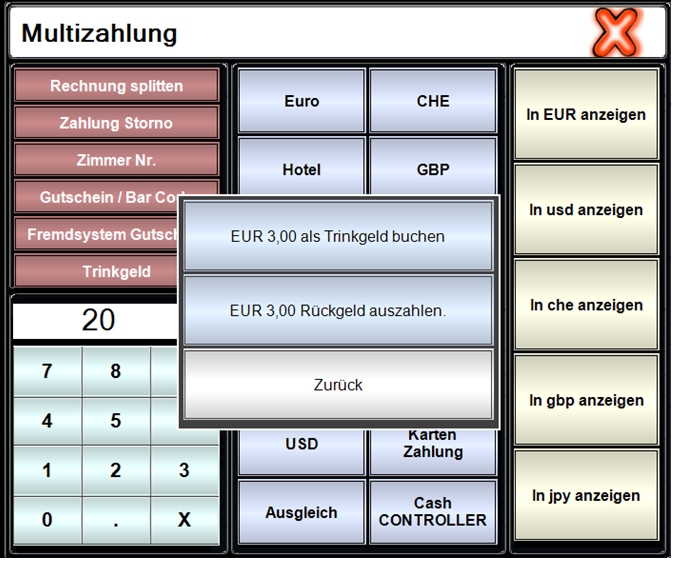

Tip query for overpayment at POS and mPOS

This function can be activated for Hypersoft POS systems in the station management: Tip query in case of overpayment. This setting works in multi-payment. The multi-payment does not take into account the cash register function Book balance as tip.

For Hypersoft mPOS systems, there is a switch with a corresponding switch for booking overpayments as tips in the settings there: Tip query in case of overpayment

If the checkbox Tip query for overpayment is activated, the system asks whether the overpayment is to be posted as a tip or paid out as a change in the case of overpayment. If you use Back, the payment transaction will be cancelled.

Display Hypersoft POS:

Representation Hypersoft mPOS...

Tipping at the mPOS...

See also Split with tip and multiple customers at mPOS .....

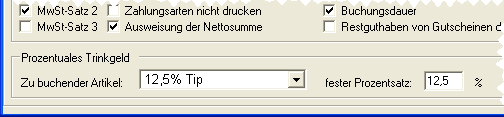

Another variant used in countries such as England and the USA is the percentage tip, which is determined on the basis of the invoice amount. The percentage tip is calculated at the end of the transaction and printed on the form. At the same time, the tip is recorded as collected and can be evaluated in the same way as other tips.

Establishment of the percentage tip...

- Create a base item without tax. The text of the base item is used on the form and in evaluations. The text does not have to be TRINKGELD.

- Select the item in the form setting and next to it enter the percentage rate that is to be added to the transaction as a tip on the basis of the gross amount.

-

- Complete a transaction with a close macro that contains this form.

- Variant: You can also post all the items assigned to the forms as percentage tip items to the activity and thus determine the tip amount for the activity.

The tip calculated with this method is displayed separately at the end of the transaction total. This special display applies in a system as soon as a single form has been set up for the percentage tip.

If you have manually posted a tip item in the transaction, this function is no longer executed. However, the display of the tip at the end of the transaction remains unchanged.

If you edit a task with Edit task or Revise task and reopen it, the tip (both the percentage and the tip posted via the Tip item) is removed and recalculated at the new close. The system notifies the operator of the amount of the tip removed so that the operator can re-enter it if necessary.

The tip amount is also rounded according to the settings of the discount roundings.

The tip is shown separately in the operator report (front office report). In most other reports, as well as daily closing and payments, the tip is not shown. The tip is not included in the cash turnover. If, for example, cashless tips arise, these can reduce the sum payment in BAR.

Background information on tip handling:

The operator receives the tip quickly - he interprets it, as it were, because there is no technical possibility to receive it in cashless payment. Since the operator receives the cashless tip when settling in cash, the cashless payment remains with the amount paid (including tip) and the payment in cash is reduced by the tip. The cashless total thus represents the total of the cashless receipts and the total in cash is finally handed over by the operator as cash.

The Report Manager contains other reports on tips, the tip overview, and the tip details.

In the Front Office Report, you can evaluate tips in the financial report.

Further topics:

Further topics:

Hypersoft procedure with tip bookings

Back to the overarching topic: Book a tip