Points to note on accounting

SEPA direct debits

The file created by the accounting programme for the automatic execution of direct debits is compatible with all common bank programmes and your bank branch can also execute these orders for you.

Transfer from POS to Accounting

To the invoice status...

Transactions with the payment type on customer account are transferred (like all paid transactions) to the cash transactions, but additionally create a payment order in MOBILE PEOPLE Accounting. When transferring to accounting, a distinction is made as to whether the POS system has used a form that acts as an invoice or not. Because if the transaction was created with the payment type on customer and a form with invoice number, then it is settled in accounting but when an invoice run is carried out in accounting, an invoice is neither created again nor is it printed or emailed again for delivery.

It is also necessary to store a free form in the macro with payment type on customer account.

Open items at the POS and in accounting...

There is a double use of the term OP / Open items, respectively their status is different from the point of view of the POS system and the accounting:

In the POS system, transactions with the payment type Payments to customer account are automatically OPs (open items) after the transaction is completed, as the invoices from accounting can / should be sent to the customer.

in Accounting, these transactions are listed in the area of payment orders. Only when invoices are created in Accounting from the payment orders do these open invoices appear in the area Open items (of Accounting). From an accounting perspective, these are now settled and open items. The POS system no longer has to "take care of it" and therefore the open items at the POS system are considered cleared. When the OPS are invoiced in accounting, the OPs are no longer displayed as OPs at the POS.

The open items of the POS system can also be called up again there and also paid in such a way that they are no longer passed on to Accounting for settlement. See for this Load open payments at POS.

Processing of transactions at the POS and effects on accounting...

A transaction that has been transferred to accounting for settlement can still be processed at the POS and will then also be updated in accounting.

When a transaction has been settled at Accounting, the transaction is considered settled for the Hypersoft POS system. If a transaction has already been settled in Accounting, it can no longer be processed at the POS, or no update can be triggered in Accounting by the POS system.

Solution for correction from POS to Accounting by return reversal...

With a return reversal you can make an offsetting entry, which is then transferred to Accounting. This allows you to transmit a negative amount, which your customer may offset against outstanding invoices.

The function of our return reversal does not check whether there is a positive booking, but freely books a specific item as a return.

Collective invoices

As several invoices can be combined into one collective invoice, several transactions are listed under the same accounting invoice number. The invoice numbers assigned byAccounting are also transferred to the internal invoice table.Accounting This means that they can also be output in DATEV and in the invoice report.

Note: Invoices will only be considered after 10.08.2021 (before then only in exceptional cases).

Corporate members and groups...

If a customer is a member of a group/company, the invoice is issued to the company and the name of the hosted customer is now indicated on the individual receipt.

The TSE signature is generated at the POS system. Give these receipts to your clients when you need to hand over the signature. See this:

Payments at the POS according to Accounting Payment Order

If a transaction has been processed further in Accounting to become an invoice, this transaction can no longer be processed in Cashier Mode. One possibility of accepting a payment from the customer at the checkout is to book it at the POS as a cost item deposit (cost item) and to inform the accounting clerk of this payment. In this way, the payment information can be transmitted to the open item in accounting.

The correct accounting for tax purposes

In order to avoid double input tax or incorrect settlements, you should only create a VAT-deductible invoice at one system, that is, cash register or MP Accounting. Coordinate the legal part with your tax advisor if necessary. For setup questions, please contact Hypersoft Support or your Hypersoft reseller.

|

The transaction has now been transferred from the cash register to MP Accounting. |

|

The transaction has been invoiced and there is an open item waiting for incoming payment. |

|

A partial payment has been made, the process is not yet complete. |

|

The invoice has been paid in full and the process is complete. |

Payment orders are generated at the cash desk and transferred to MP Accounting.

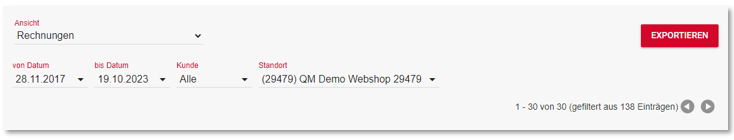

Export invoice number per location

Should you wish to export your invoice numbers from Accounting in the event of a tax or tax audit, you can do this via the Invoices module by selecting the desired location as well as the period to be audited.

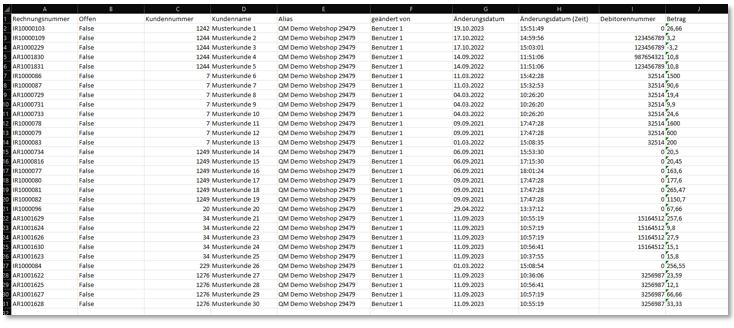

The export gives you a list of all invoices of the desired filter as an .xls file:

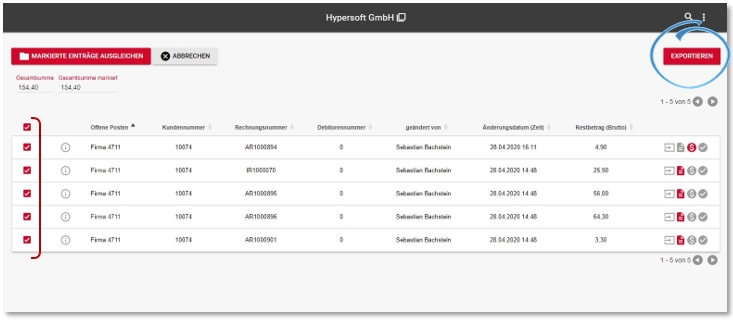

You can export the entire list, or the corresponding selection if you have selected Create invoices or Process selected entries. Statistics are displayed in the table above the export.

Please note that either all rows are always exported or only the selected ones. Make sure you know what you want to export and that you have selected rows before you export.

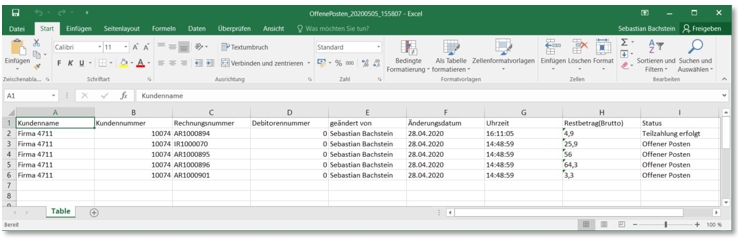

The export is in a format for Microsoft Excel (c). This is how the export is displayed:

For payment orders you will receive: | client name | client number | posting number | invoice number | customer number | posting date | time | amount (gross) | status

For open items you will receive : | customer name | customer number | invoice number | customer number | changed by | date of change | time | remaining amount(gross) | status

The total amount refers to the amount (gross) within payment orders and to the remaining amount (gross)within open items. Grand total marked counts the same columns as Grand total but only from the selected entries.

archives

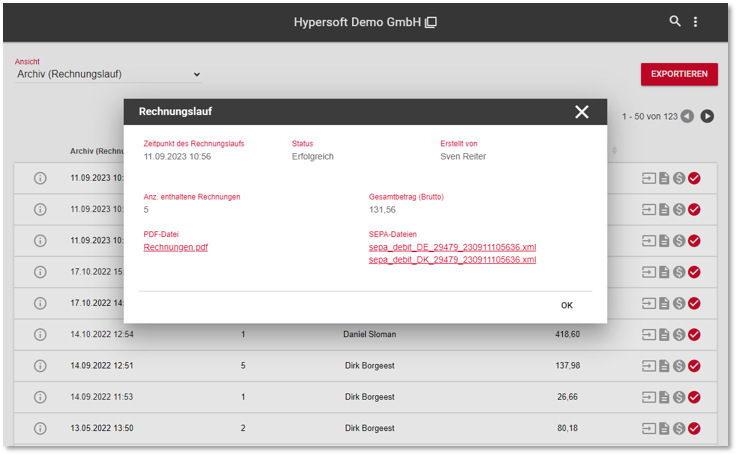

The invoice runs can be viewed in the archive. When you select the line with the invoice run, the system takes you to the dialog for the invoice run.

In the invoice run dialog the core information can be called up again, as well as the SEPA files and the PDFs with all invoices contained therein.

In order to avoid conflicts due to simultaneous access while editing the tasks, these are locked during editing for other instances and programs. If the cashier mode opens a payment order for transactioning, the transaction can no longer be processed in the portal, even the retrieval of the same transaction at another cashier is rejected until the transaction has been released again by the transactionor. During an invoice run, all affected transactions are blocked for the CLOU. Transactions that have been blocked by other persons must not be included in the invoice run.

To edit an open item, it may happen that the operation has been blocked by a user or operator. In such cases, the appropriate information is displayed, indicating who blocked the operation and where. Selecting the lock text removes the lock so that you can continue working with the operation.

This forced release should be used with caution, if the blocking is justified, the other user will not be able to save his changes. In the portal, no forced release can be performed on an operation that is being processed at the local POS system. For this release, the transaction must be completed at the checkout.

SEPA direct debits (data medium exchange)

The SEPA Core Direct Debit is an EU-wide standard for direct debit schemes. The program creates such orders as a file in a standard format that can be read by all common bank programs. In your bank program (if you have any questions, please contact your house bank), the direct debit of your receivables will then take place automatically.

The SEPA files are created automatically during the invoice run and can then be downloaded for further transactioning. Certain factors are decisive for the creation of SEPA files (for direct debit or credit transfer).

In the customer data, the bank details and the payment agreement must be set to (1 monthly data medium exchange or 4 daily data medium exchange), where the mandate date can also be stored. The SEPA Creditor ID must be defined in the settings.

MP Accounting can also send invoices by e-mail. A mail address must be entered in the customer master and invoice (mail dispatch in A4) must be activated.

The mail address and the name under which the invoices are sent should be entered as the sender in the Mail Settings section of the Settings. The mail text is also entered in this setting. (For more details, see Accounting Settings)

In the invoice run, the mails are prepared and sent.

The invoices sent as mail are not output again for letter dispatch.

Back to the overarching topic: Accounting