Fiscal law in Germany

In Germany, the requirements for cash register systems are specified by the Federal Ministry of Finance. For this there are the principles for the proper keeping and storage of books, records and documents in electronic form as well as for data access (GoBD). In addition, the Kassensicherheitsverordnung will come into force in 2020.

For conventional export of cash register data until 31.12.2019: Journal and export also for AmadeusVerify

For the 2024 update by the application decree, we have compiled extensive information here: Fiscal Law on the Application Decree on Section 146a AO

Information on the Cash Safety Regulation 2020 for the reconstruction of the then gradual commissioning and communication: Statement on the Cash Safety Regulation and TSE 2020

Information on the Notification obligation pursuant to Section 146a (4) of the German Fiscal Code (AO)

Step by step compliant with the Cash Protection Ordinance 2020

| Prio | Cash Security Ordinance-Topic | Availability |

| 1 | Compatible cash register system | yes: Hypersoft SP 7 |

| 2 a | GoBD conformity | GoBD is the responsibility of your company. Hypersoft supports through techniques and best practice. Examples Hypersoft Security, Systematic cancellation and loss management and Hypersoft POS Cash Handling |

| 2 b | Procedural documentation | see official GoBD information |

| 2 c | Cash register inspection compatibility | see official GoBD information |

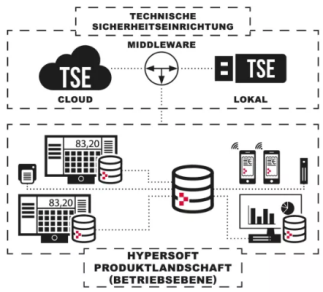

| 3 a | TSE Integration - Connect TSE with POS system | TSE installation |

| 3 b | TSE Integration - TSE signed on documents | Possible since SP 10 from April 2020 |

| 3 c | Set up and test the invoice forms with TSE information | Possible since SP 10 from April 2020 |

| 3 d | Optionally activate NoCOO - Digital Billing |

Our Best Practice Tip! |

| 3 e | TSE Integration - and Export of TSE TAR files | KassenSichV Export according to DSFinV-KS |

| 3 f | Notification obligation pursuant to Section 146a (4) of the German Fiscal Code (AO) | Notification obligation pursuant to Section 146a (4) of the German Fiscal Code (AO) |

| 3 g |

Change must be signed according to KassenSichV 2020. Unrecorded change is in breach of the duty to be cash-strapped. |

Solution with Wallet-Control |

| 4 |

Activate the optional TSE online archive - backup and provision |

Our Best Practice Tip! |

| 5 | Journal export in DSFinV-K format | KassenSichV Export according to DSFinV-KS |

| 6 a | Integrate eSolutions and partner connection | TSE with eSolutions and 3rd party integrations |

|

|

Open points summarised: |

|

| Support of the DATEV archiving system | (Implementation not yet binding) | |

| Support of the electronic reporting system can only be evaluated once the technology has been established by the legislator. | ||

| Compatibility with Amadeus Verify. You can find all information on this in the HS-SSP document in the download area of your Hypersoft portal. | From August 2022 HF 8 for SP 14 |

Important, especially regarding the GoBD

The regulations on the GoBD remain in place and are supplemented by the Cash Security Ordinance.

The Cash Register Security Ordinance has an intensified effect on compliance with the GoBD regulations through its regulations on cash register inspections (example: in order to be eligible for a cash register audit, it must be possible to traceably separate change and tips from turnover).

Essentially, it must be ensured that the accounting data is stored completely and unchangeably. Note the wording, as this must ensure that the system is able to save posting data completely and unchangeably. Conversely, if you cannot credibly demonstrate that the system is able to do this, the booking data can be discarded even if it has not been manipulated.

Record and read about Book a tip(tax-free) tips.

Book invitations and other unsold goods as losses and read about this Systematic cancellation and loss management.

For handling change, use Wallet-Control.

Use one of the voucher systems and never use a solution "next to the cash register". See for example the solution Web-Vouchersor (for small single farms) The voucher (offline) management. The relevant details for the current program version are described in the current HS-SSP document. As a user with appropriate permissions, you can download this document from the MyHypersoft portal or have it sent to you by our support.

The GoBD regulations remain valid and are supplemented by the Cash Register Security Ordinance. The Cash Register Security Ordinance tightens compliance with the GoBD through its requirements, especially for cash register inspections. For example, it must be ensured that change and tips can be recognised separately from sales in a traceable manner in order to ensure that the cash register can be used.

The core requirement is that the booking data is stored completely and unalterably. The wording of the regulation is crucial here: systems must be technically capable of storing booking data completely and unalterably. Otherwise, tax authorities may reject the data - even if there has been no manipulation.

Notes on practical implementation:

Tips: Tax-free tips should be systematically recorded. Details can be found under Book a tip.

Invitations and unsold goods: These are correctly recognised as losses. Further information on this can be found in our Systematic cancellation and loss management guide.

Change: We recommend the use of Wallet-Control to manage change.

Voucher systems: Use an integrated voucher system and avoid solutions that are operated outside the POS system. Examples of this are web vouchers,

Further information:

The latest details on these topics and on programme use can be found in the current version of the HS-SSP document. Authorised users can download this from the MyHypersoft portal or request it from our support team.

Cross-border use

Hypersoft supports both German and Austrian tax requirements. With Hypersoft's technical solution, you can couple both systems for cross-border companies so that each cash register signs according to both German and Austrian tax law. For this purpose, two QR codes per receipt are generated and issued if required. The control takes place via the country-specific tax rates. As the currency in both cases is the euro, we do not believe that an extensive changeover of the cash register system is necessary when crossing the border. Discuss the set-up of the POS system for this case with Hypersoft and have the tax conformity confirmed accordingly by both countries.

No tax or legal advice

The following information is for general guidance only and does not constitute tax or legal advice.

Hypersoft is not authorised to do this.

Please check the contents carefully and, if necessary, consult with your tax advisor or another competent person to ensure that your approach complies with the applicable legal and tax requirements.

If necessary, adapt our advice to your individual circumstances and record the results in your procedural documentation.

Further topics:

KassenSichV Export according to DSFinV-KS

Notification obligation pursuant to Section 146a (4) of the German Fiscal Code (AO)

Process description Hypersoft POS

Cash Guarantee Ordinance Questions & Answers

Fraud Protection Status Booking Journal

Journal and export also for AmadeusVerify

3rd Party eSolution fiscal requirements

Back to the overarching topic: Hypersoft Security