Wage type configurator

The wage type configurator can be set so that it applies the tax-free bonuses valid in Germany for Sunday, public holiday and night work according to § 3b EStG, or you can specify manual settings (also for tax-free bonuses).

Employee settings or salary configurator...

If you select Consider employee settings, the other elements for the setting are hidden and the German standards are applied. You can make further settings and restrictions in the employee data.

See also the description of the section Wages in the employee master record.

If you choose Include wage type configurator, you can make manual settings.

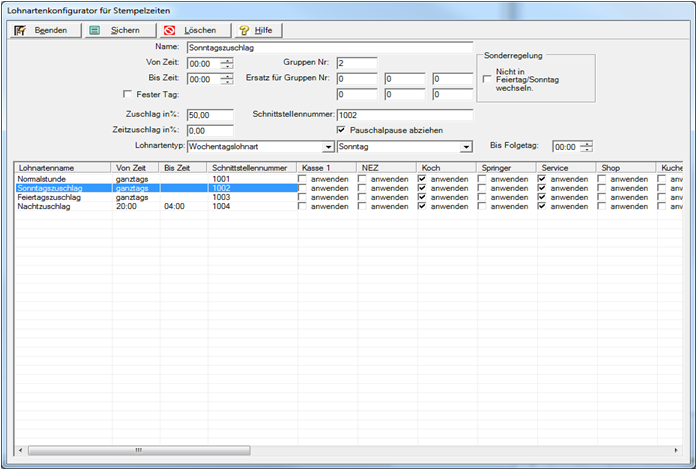

Define the wage types that are to be used for the time data recorded for your employees.

Basis for calculation of theoretical wage costs or hourly wage

The value Theoretical hourly wageis calculated using the settings in the wage type configurator. It therefore also includes surcharges, regardless of whether they are entered manually or applied automatically. Per se, this wage remains theoretical, since only a pay slip can calculate all costs exactly. The wage type configurator is able to configure wage types such as normal hours, overtime hours, Sunday hours and night hours. The wage type category is divided into day wage type, overtime wage type and weekday wage type.

From the Printer and Interfaces program group, choose the Wage Type Configurator program.

View with self-determined wage types...

View with standards...

| Element / Switch | Function / Description |

|---|---|

| name | Enter a unique name for the wage type. |

|

From time and Until time |

Enter the time for which the wage type is to apply. If a wage type is to be valid for a whole day, the time from 00:00 to 00:00 must be stored. |

| Solid day | This holiday is then always valid on that date. |

| Surcharge in % of | This information can then be used as the basis for a Hypersoft program that will appear later or can be used for export and transfer to the payroll office. |

| Time surcharge in % | Enter a time surcharge that is to apply in this period. Time bonuses can also be applied together with wage bonuses, in which case the wage bonus is applied only to the actual time, not to the time bonus. |

| deduct flat-rate pause |

Individual wage types can be set so that they use automatic breaks or not. For example, you can treat times with surcharges differently from times outside of surcharges. pause recordingFurther topics: |

| Calculation from |

Surcharges can only be calculated for a preset number of hours or more. This number of hours must be reached at least (taking breaks into account) in order to receive this wage type. However, this is then also applied for the time until the validity is reached. |

| wage type category |

Choose the wage type category that corresponds to your wage type. The daily wage type is a wage type that applies equally every day. She doesn't know the difference between the days of the week. The overtime wage type is used depending on the number of hours worked per day or month stored in the Basic Data tab in the employee master record. If a stored threshold value is exceeded, the wage type is used here. Select a weekly wage typeto select a weekday on which this wage type is applied. The weekly wage type is valid all day. The holiday wage type is automatically applied to the holidays of type 1 and 2 defined in the holiday table. The missing hours wage type can determine the missing hours in the same way as overtime, if the monthly or daily target is not reached. The number of hours determined will not be transferred from the program to the following month. The transfer can be transferred to subsequent programs by exporting. Further topics: |

|

Group No and Replacement for group no. |

You can define any number of wage types in overlapping periods. Special wage types are configured so that they replace other wage types. Each wage type can have a freely definable group number. Using the function Replace for group number, the respective wage type takes precedence to replace another wage type. With this it is for example possible that a night hour of level 2 which starts at 00:00 o'clock replaces a night hour of level 1 which started at 20:00 o'clock from 00:00 o'clock. It is also possible to replace another group for overtime hours, so you can reduce the normal hours by the overtime hours and then, for example, perform a calculation with 125%. However, it is also possible to charge overtime in addition to the normal hours with only 25% extra. These two types of configuration will later influence the wage calculation. Model 1: Overtime is paid at 125%, or Model 2: Overtime is paid at 25% and the remaining 100% is charged to the hours account. (dawdling). Sunday hours can be entered here in the form of weekday hours with the additional info Sunday. This type of weekday wage type also makes it possible to map special company rules. You set up days such as rest days on Monday accordingly, but whoever has to work gets a percentage surcharge. In addition, all wage types can be freely activated for employment types such as management, kitchen staff, temporary help, and so on. For this purpose, a column is inserted for each employment type. Use with hook applies the wage type for the corresponding employment. If you want to apply wage types without assigning occupations, select the checkbox Apply in the column Without assignment. Since more than one employment type can be assigned per employee, wage export only uses the employment type assigned first in the list. Only those employees who have a personnel number in the employee master record are included in the calculation. |

| interface number | Gives the wage type a unique number in the interface to the further processing systems. |

| holiday schedule | If you work beyond 0:00 a.m. into a public holiday or Sunday, the public holiday or Sunday is calculated from 0:00 a.m. onwards. With the setting Do not change to public holiday/Sunday, the public holiday is not activated when working in. |

| Until next day | Surcharges for Sundays and public holidays can also be calculated into the following day until 04:00 hours if work is done into the following day above 0:00 hours (statement valid 2010 in Germany). Here you can set this time for the following day. |

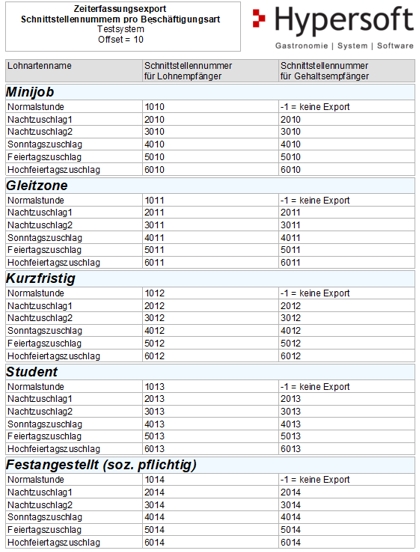

| Option for interface number |

It is possible to extend the interface numbers assigned by the system by a so-called offset. A 10 means that for interface number 1000, the 10 is added as an offset and the employment type, resulting in the following interface numbers: 1010 = mini-job 1011 = sliding zone 1012 = short-term 1013 = student 1014 = liable to social insurance. |

| print view |

You can print the interface numbers for your payroll accounting. To do this, click on the print preview in the Option for interface number area.

|

The specifications of the wage type configurator are also supported if you specify negative values. For example, if you only want to count a wage type in the hours area, but not in the costs area, you can enter -100.0%.

Missing interface numbers of wage types used are marked with 99xx during export.

Further topics:

Time recordingBack to the overarching topic: