Master goods movements

Specific solutions for special requirements relating to goods movements:

Best practice: Different place of consumption for goods

In many companies, controlling fails not because of the technology, but because of a lack of understanding of the structure. As soon as goods are not consumed where they are sold, uncertainty arises.

-

Who bears responsibility?

-

Where is inventory being reduced?

-

And why do theory and practice never coincide?

If these questions are not answered properly, inventory management remains a farce. With the right structure, however, it becomes a precise management tool.

Basic understanding: A point of sale is not the same as a salesroom

In the Hypersoft Controller, only the following organisational elements exist:

-

main warehouse

-

Points of sale (POS)

A kitchen is technically a point of sale, a cocktail bar is technically a point of sale. even if they are in fact production areas. Why? Because a point of sale in the controller is nothing more than a defined place of consumption with responsibility. It is precisely this understanding that is crucial. The actual problem based on a typical sequence of events:

-

The restaurant sells steak.

-

However, it is stored in the kitchen.

-

It is produced at the barbecue station.

-

It is consumed in the dining room.

If it is not clearly defined where the stock is to be reduced, this automatically leads to unclear responsibilities, theoretical stocks in the wrong place, and discussions instead of control. Many companies therefore never dare to implement a clean solution, but without this separation, controlling remains ineffective.

This is how the solution works, with a standard rule in stock management:

If an item is sold at a point of sale and is also stored there, the stock there is reduced.

If it is sold there but not stored, the stock in the main warehouse is reduced.

This is sufficient for simple structures, but not for professional businesses.

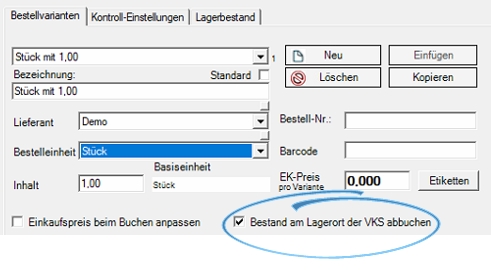

The decisive option is the switch in the article master: Deduct stock at the VKS storage location:

This function allows an article to:

-

be sold at a point of sale

-

but reduce the stock at another point of sale

This ensures that the actual production location is charged correctly. Without this option, the theory remains incorrect.

Example 1 – Steak from the kitchen, sold in the restaurant

The "restaurant" point of sale sells the steak.

The storage location is the "kitchen" sales outlet.

The following is activated: "Deduct stock at VKS storage location".

Result:

The stock is being reduced in the kitchen –

Not in the restaurant, not in the main warehouse.

Responsibility remains where production takes place.

Example 2 – Cocktail bar as a production site

All areas sell cocktails. They are produced in the cocktail bar. Without correct allocation, the cocktail bar would be 'uncontrollable' because sales in the restaurant or outdoor area would not appear there.

With the correct point of sale allocation:

-

Sale to VKS Restaurant

-

Consumption is booked at the VKS cocktail bar.

-

The bar is given clear responsibility for consumption.

Suddenly, performance becomes measurable. This is not mistrust – it is professional structure.

Convenience principle: The Steak House example

A steakhouse chain separates meat processing at headquarters from the sale of portioned cuts at the restaurant.

Only "250g rib-eye pieces" count at the location.

Goods and money are kept separate for organisational purposes.

If you want to take advantage of this without a central unit, you can map the production process in the controller:

-

Book raw materials

-

Parrying as a production step

-

Record waste as a loss

-

Create finished steak as a countable unit

-

After that, you just count the pieces.

Like a convenience product. This transforms meat processing into a controllable entity.

Why this is crucial...

If the point of sale and place of consumption are not clearly separated:

-

losses are spread across all

-

the beneficiary alone benefits

-

manipulation remains invisible

-

controlling loses its effect

If, on the other hand, the structure is clear:

-

deviations can be localised

-

real areas of responsibility arise

-

performance can be promoted

-

automation becomes reliable

Only then will it work:

-

automatic assembly

-

Order suggestions

-

consumption analyses

-

control registration

-

management message

If you have not yet dared to try this solution, the problem was probably not the technology – but the complexity of the mindset. But this is precisely where professional stick management begins. Without a clearly defined place of consumption, any inventory management remains a statistical game. This structure makes it a management tool.

Comments on the option "Deduct stock at VKS storage location"

For your information: Recipe items contain basic items. Only basic items (and own products) are kept in stock. A recipe does not have its own inventory, as booking a recipe in Hypersoft always triggers real-time production.

Example: cocktail bar:

Recipe: Screwdriver

Basic ingredients: vodka and orange juice

The recipe is being sold.

The stock of vodka and orange juice is being reduced.

All three items are assigned organisationally – but only the basic items carry the inventory.

Basic principle of point of sale allocation (VKS)

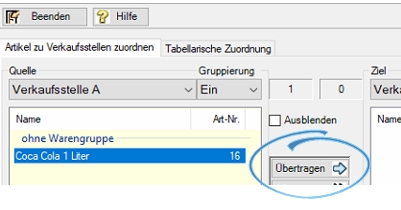

Normally, you assign items from the main warehouse to one or more sales outlets (VKS). However, if you select a point of sale as the source and assign the item to another point of sale, you are determining the following:

-

The item can be booked at the destination.

-

However, the stock is reduced in the source.

This is precisely where the strategic strength of the system lies.

Example cocktail bar → restaurant

In our example, only the "Screwdriver" recipe from the cocktail bar is assigned to the restaurant. That means:

-

The drink can be ordered at the restaurant.

-

The stock of vodka and orange juice is being reduced in the cocktail bar.

-

The printing of order slips is independent of this and purely organisational.

Logistically speaking, the drink therefore "comes" from the cocktail bar – even if it is sold in the restaurant. This is how genuine accountability is created.

Important note regarding setup in the controller

When working with the controller, the following always exist:

-

a main bearing

-

at least one point of sale

If only one point of sale exists, new items are assigned to the sole point of sale by default, while stock items are kept in the main warehouse. You can assign items directly in the item master of a point of sale, but then the source/target principle described above will not work. For such scenarios, you must use the Set up sales outlets programme. Example: 1 litre of cola:

-

Basic item: Cola 1 litre

-

Storage location: Main warehouse

-

Point of sale A

When sold, the stock at sales point A is reduced and replenished from the main warehouse. Now, cola is also to be sold at sales outlet B – but stock is still to be reduced at sales outlet A.

Procedure: In the Set up sales outlets programme, select Sales outlet A as the source and assign the item to Sales outlet B:

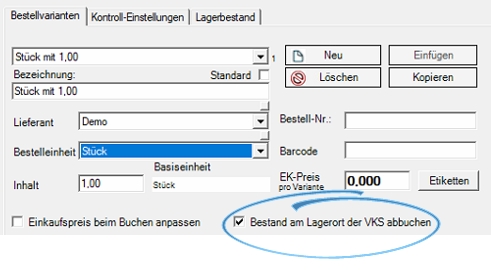

Now activate the switch in the article master: Write off stock at VKS storage location:

Result:

-

Sale at point of sale B

-

Stock reduction at sales outlet A

-

The item does not appear in B in the control entry.

This ensures that responsibility remains clearly assigned.

Strategic background

Many businesses fail not because of technology, but because of logic. If these connections are not understood, controlling seems complicated – and people are afraid to tackle the solution. Without this structure, however, controlling remains a farce.

With this structure, it will be:

-

comprehensible

-

automatable

-

accountable

-

and economically effective

And that is precisely the difference between "maintaining inventory" and "managing inventory".

Best Practice: Book differences as consumption

We have demonstrated:

-

Recipes automatically reduce the stock levels of the base items.

-

Production steps enable the separation of goods and cash flow.

-

Losses can be booked cleanly at the place of production.

Now we come to the third variant:

Consciously post differences as consumption.

What is it about? There are items and situations where the inventory cannot be completely cleared by cash register entries. This is common:

-

during the introductory phase of stock management

-

for auxiliary items (spices, cleaning products, small consumables)

-

for items that cannot be meaningfully represented in recipes

-

in very complex kitchen structures

However, simple and feasible checks and automation should be carried out. To this end, it has proven useful to have all items checked (at the latest before a planned order). In these cases, employees record the actual stock, and the difference is posted as consumption on a flat-rate basis. This is not a weakness – it is a conscious system decision.

Why this makes sense

It makes perfect sense to count all items in a kitchen – even if you only actively control valuable items such as fillet or scampi using recipes, because.

-

Counting is done anyway.

-

This makes inventories reliable.

-

Automatic order suggestions remain correct.

-

"Invisible" losses become visible.

The failure to record supposedly "unimportant" items has led to the disappearance of goods in numerous businesses – whether cleaning products, spices or caviar: once gone, they're gone.

Practical example

You only keep valuable items in your kitchen, such as:

-

fillet

-

scampi

Recipes are stored for these basic items. The system calculates a theoretical target stock level. During the control recording, actual and target stocks are compared. Differences are clearly indicated.

Other items – which are not listed in recipes or are only listed incompletely – would also show discrepancies during an inspection. However, these would not be meaningful to interpret, as there is no theoretical consumption.

Solution: Control groups with "Post differences as consumption"

Assign these items to a control group with the property: Post differences as consumption. This results in the following:

-

Stock discrepancies are not assessed as differences.

-

but booked as actual consumption

In Stock Reporter, you can use the radio button: Consider consumption from control to control how these values are displayed:

If the switch is activated, this consumption is included in the theoretical consumption. If it is not activated, the deviation appears in the Difference column of the control closing report.

Strategic classification

This method is particularly important when:

-

You do not wish to display all items based on recipes

-

You still want fully automatic ordering

-

Gradually grow into professional controlling

The decisive factor is:

-

Not every article needs to be perfectly modelled in theory.

-

But no article should go unnoticed.

management concept

Consciously recording it as consumption is more honest than silently losing it. Controlling works not only through maximum detail, but also through clear systematics. Those who classify consciously remain in control.

Further topics: Directory: Best Practice

Base item as sales unit & free base unit

This chapter describes two special scenarios for handling base items in Hypersoft Stock Management.

1. Purchasing and sales identical (1:1 structure)

With simple items – e.g. a 0.2 litre bottle of cola – the question often arises: should I create a recipe and link it to a base item? Or do I make the basic item saleable myself?

Both are technically correct.

Option A – Separation into recipe + base items

-

Basic article manages stock

-

The recipe is the product being sold.

-

Uniform structure for complex product ranges

This option is useful if:

-

You mainly work with recipes

-

You prefer a uniform system logic

-

You want to map production steps

Variant B – Basic items ready for immediate sale

-

Purchasing unit = sales unit

-

No additional recipe item required

-

Lean product master data

This option is useful if:

-

Many items are bought and sold at a ratio of 1:1.

-

The range is simply structured

Important:

Both paths lead to the same result. Consistency in system design is crucial – not the method.

2. Free base unit (variable purchase units)

It becomes more complex when: An item is purchased in different containers but sold in fixed portion sizes. Example:

Shopping: 0.2 l, 0.7 l, 1 l, 1.5 l cola

Sold in: 0.2 litre glass, 0.4 litre glass, long drink

There is no 1:1 relationship between purchasing and sales here.

Practical recommendation based on experience

In most companies, a static purchasing unit has proven its worth. She is:

-

easier for employees

-

more transparent in controlling

-

more robust in everyday use

When variable purchase units are required

If price or availability reasons necessitate different packaging, the following solution is recommended:

Base unit = litre (for food: kg)

Neutral product description, e.g. "Cola"

Purchasing units are defined as order units of litres.

-

0.2 litre bottle

-

1 litre bottle

-

1.5 litre bottle

The recipes then use litres as the unit of measurement. All types of containers can be recorded during control recording. The control closure automatically converts to litres (or kg).

Key insight

If you understand this system logic:

-

you are no longer dependent on the container

-

can shop flexibly

-

your controlling remains stable

-

and automatic order suggestions work correctly

Your key idea behind this is very powerful: many companies do not dare to use inventory management because they believe that their purchasing reality does not fit into the system. But that is exactly what this structure is designed for.

Back to the overarching topic: Best practice for inventory management