Noteworthy general information on payments

Cashless payment should work simply, reliably and at all times.

Billing must be a positive, transparent experience for owners, employees and guests. It is equally important that all cashless payments are fully congruent with the bookings in the POS system. Once this requirement has been met, all that remains is the traceable accounting of incoming payments - clear, secure and auditable.

With its integrated payment solutions, Hypersoft ensures that transactions, bookings and incoming payments are automatically synchronised - for consistent and efficient payment processing.

Best practice: Accept all payment methods - for better customer loyalty

As already explained in the topic on eSolutions Payment, the new motto at stationary payment terminals has long been: Accept all means of payment!

Of course, Mastercard and VISA dominate in Europe, and in Germany girocard (formerly EC card) is still the standard. But the trend towards smartphone payment is changing the game: the actual card is often no longer visible to the guest - it is behind Apple Pay, Google Pay or other wallets. If you reject card payments across the board, you may be rejecting several payment methods at once - and losing the customer without realising it.

Our recommendation:

Let your guests decide for themselves which card they "insert" into their smartphone. You should not refuse to pay just because you think you will save on fees. Because:

-

Payment methods only cost fees when they are actually used. The mere provision does not incur any running costs.

-

Unsupported means of payment lead to hidden sales losses.

-

Supposedly expensive providers such as AMEX can very well pay off economically due to significantly higher average receipts.

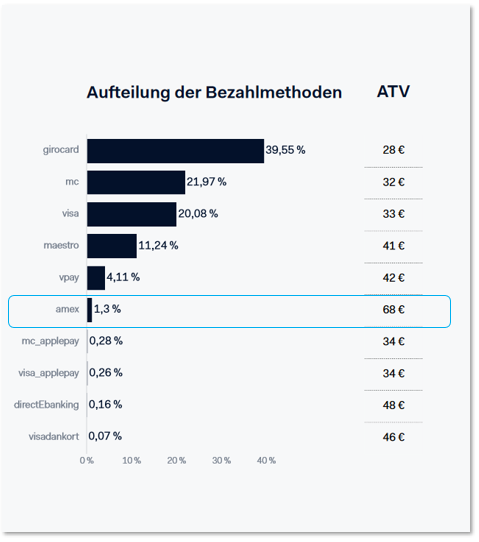

Example from our 2023 analysis

Our own analyses of our own customer base show that AMEX customers achieve on average twice as many receipts as the overall average.

Even with transaction fees for the AMEX card around 1.5 % higher than the average, this remains a profitable business.

Conclusion:

Those who think strategically about payment acceptance win - not only sales, but above all customer satisfaction. Avoid unnecessary hurdles - the best payment is the one that works.

With the double average receipt, possible additional costs of 1.5 % for certain payment methods should be easily absorbed in your overall concept. Our analyses show informative data that you can use for evaluation. What they don't show, however, is the turnover you lose through declined tickets - and this loss goes unnoticed in many establishments because the guest simply leaves without saying a word or never comes back. This is precisely why the following applies: those who really think economically do not primarily optimise fees - but customer satisfaction and return rates.

Further topics:

Best practice: Guaranteed success with PayPal

Best practice: Avoiding the time-out trap in full service

Time-outs in cashless payments are particularly treacherous in the catering industry - they lead to confusion, delays and sometimes even double charges or unpaid transactions. The problem can be completely avoided with a little understanding of the system and proper configuration.

Why time-outs occur at all

With cashless payment, several systems talk to each other:

-

The cash register starts the payment.

-

The payment terminal sends the amount to the computer centre.

-

The computer centre makes a request to the card-issuing bank (issuer).

-

The answer comes back the same way.

Problem: Each of these systems only waits a certain amount of time for a response - so-called "timers". If a timer expires without a response, the process is deemed to have failed - even if the payment actually worked.

Why the catering industry in particular is more frequently affected

Unlike in the supermarket or at the petrol station, the payment process often takes longer in restaurants - e.g. because the terminal is first brought to the table or because guests are still in discussion. This reality collides with standard time settings:

Standard in retail: approx. 30 seconds timeout

Recommendation for the catering trade: 3-5 minutes

Technical background: Who waits how long?

-

The payment terminal is waiting for the computer centre.

-

The checkout is waiting for the payment terminal.

The timers must not be the same length! Otherwise there will be a fatal mismatch:

The terminal has paid - but the cash register has not received any feedback.

Therefore important:

The time-out setting of the Hypersoft cash register must be at least 1 minute longer than that of the terminal.

What happens during a time-out

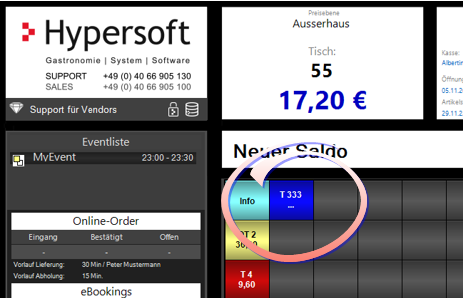

If the cash register does not receive a response, the process is cancelled - the table appears blue in the table list (→ "Blue table"). The payment status is then unclear.

The status can only be clarified by enquiring at the terminal or with the guest.

How to reliably avoid time-outs

✅ Check the configuration:

Make sure that both time-outs are correctly adjusted. Test after every system change!

Further topics: Time-out setting

✅ Check network quality:

A stable WLAN (even when fully utilised!) is crucial. Even a human body between the terminal and the access point can make the difference.

✅ Training of all operators:

Mistakes often happen because not all employees are familiar with the processes.

✅ Special advantages with Adyen & PayPOS:

Adyen terminals:

Hypersoft Pay powered by Adyen can automatically query the status from the data centre in the event of a time-out - the blue table usually disappears after approx. 1 minute.

PayPOS devices:

Payment is finalised directly at the table - a time-out is not possible due to the system.

Conclusion: Time-outs are not destiny

A small configuration error - big impact: unclear payments, unsettled guests, missing sales.

With the right attitude, a stable network and trained personnel, you can avoid this trap - permanently and securely.

Further topics:

Operator authorisations for cashless payments

Cashless payment has long been standard - and at the same time a responsibility. To ensure that every transaction runs securely, smoothly and transparently, it is essential to familiarise all employees with the processes and provide them with targeted training.

Our tip:

Block cashless payments on the system side until your employees are qualified to do so. This ensures that your guests always receive a professional payment experience - and that subsequent queries or billing errors are ruled out.

Understanding and avoiding technical and commercial risks

Commercial risk: Chargeback

Every cashless payment is checked by the data centre - often within seconds. Various criteria are used to decide whether the transaction is accepted. But even confirmed payments harbour a residual risk: a so-called chargeback can be triggered later, e.g. in the event of a dispute or card misuse.

What you can do:

Avoid risky payments, e.g. unusually high amounts or bookings from customers whose identity or ability to pay is unclear. Train your employees for such situations - and lay down clear rules in advance on how to proceed.

Example:

If in doubt, issue an invoice rather than making an uncertain payment. This allows you to stay in control - and significantly reduce the risk.

Limitations for payment providers

Many providers define minimum and maximum amounts, so-called amount windows. Payments outside these limits are rejected - for safety or economic reasons.

Important:

Your employees should know these limits - and be able to respond confidently when talking to guests: "Yes, we accept card XYZ - up to an amount of X euros."

Another risk: expired timers. If the cash register and terminal are not coordinated, a transaction can be cancelled too early - e.g. if the terminal is brought to the table and waits too long for input.

Further topics: Hypersoft Pay Amount Window

Risks in POS billing

The greatest risk of cashless payment arises when the payment receipt cannot be clearly assigned to a POS transaction - for example, in the case of separate invoices, tips or terminals that are not connected.

Critical:

In such cases, there is not only a risk of internal discrepancies, but also serious consequences during tax audits.

Hypersoft recommendation:

Use integrated cashless payment terminals from Hypersoft. This means that every payment is automatically assigned to the correct transaction in an audit-proof manner - including tips. And: In Germany, cashless tips can lose their tax exemption if they cannot be correctly allocated.

Technical security and WLAN tips

A stable connection is mandatory:

Make sure that your terminals are reliably connected to the POS system - ideally at least one device via LAN cable. Our WLAN guidelines help you to avoid typical causes of failure.

If cashless payment fails during operation, this can have serious consequences - including the inability to bill guests correctly. So take precautions:

stable network connection (LAN or professional WLAN)

trained employees for emergency situations

clear backup strategies (e.g. invoice, alternative payment methods)

Problems and possible measures:

| issue |

Measures |

| WLAN fails |

|

| Connection to the Internet fails |

|

| Connection to the POS system fails |

|

| Payment terminals fail |

|

Alternatives in case of emergency...

For emergencies, we have considered the alternatives and make further recommendations in the chapter Payment terminals in emergency operation.

General information on payment terminals

In general, the integration of POS terminals in the way it is carried out by Hypersoft is the maximum performance variety to connect payment terminals in the catering industry. We do this for our clients, who prefer controlled and at the same time legally secure solutions.

The use of payment terminals at the POS system can be differentiated into two methods:

- POS terminals not connected to the cash registers

- POS terminals linked to the cash register. With Hypersoft we have method 2. of the connected terminals are still differentiated into two classes:

- Connected terminals for retail and Quick-Service (market standard)

- Connected terminals for digital services and full-service restaurants

Detailed information on this topic can be found in the sections Hypersoft Pay Adyen Terminals, Hypersoft Pay@Table and for other solutions in Other payment terminals.

Printing at payment terminals with Hypersoft Pay

Internal printer...

If a payment terminal has an internal printer, the printing of the customer and merchant receipt is controlled by the device. If you have any questions about this, please contact the supplier of the device if it is not a Hypersoft Pay payment terminal. As a rule, only the correct settings need to be made in the event of problems.

Special feature: Hypersoft can also send invoices and NoCOO receipts to the internal printer on the Saturn F2.

No internal printer...

If a payment terminal does not have an internal printer, you can output the printout via a Hypersoft belt printer (together with receipts from the POS system) or have the printout made via any POS printer of the Hypersoft system. If the terminal does not print, the setting in the terminal that the printout is transferred to us is usually switched off, which can happen, for example, after a device replacement or with new devices. As a rule, only the correct settings need to be made in the event of problems.

Contactless payment

Contactless payment is technically a different use of the respective "card". For example, cards from certain issuers may not always be accepted or certain functions may not be supported. In these cases, it often helps to repeat the settlement but then with the card inserted.

Limitation of contactless payment with epay...

With epay payment terminals we support the increase of the payment amount directly at the appointment for tips. In this context, the payment cannot be executed contactless by epay. Book the tip in advance or do without the combination of tip and contactless payment.

Protection of the payment terminals in the event of a cash register failure

In the standard system, the payment terminals are started from the main cash register (the server). If the main cash register or the network to it should fail, the payment terminals are also unavailable for the other cash registers. For this reason, it can make sense to have terminals started by other cash registers. If, for example, a Quick Service cash register has a fixed payment terminal, this could be started directly from there. You can make this deviating setting in the Terminal setup mode in the Start via station field.

Allocation of the payment terminals

You can determine per cashier station which payment terminals are offered there. It can be a fixed terminal or, for example, a selection of several mobile terminals. This also applies to the subsystem(s) that can control a large number of mPOS devices and payment terminals. For the assignment, use the field Terminal number.

International installations

For international installations, these or other partners are used, depending on the country. We also use the international connection options of type I via ZVT. Terminals with manual bookings at the cash register system are often used there, as this is typical for the country. We currently work with the ZVT standard for older connections and with current connections we are oriented towards NEXUS (active with Hypersoft Pay powered by Adyen).

DCC / Dynamic Currency Conversion

With Hypersoft Pay powered by Adyen card devices, your customers can pay in their preferred currency. The (possible) additional costs incurred here are borne by the cardholder.

Generally, DCC is designed to give a customer with a currency other than yours the choice at the payment terminal of paying in their local currency or in their currency.

If the customer now selects his or her national currency for payment, the terminal usually remains stuck in the currency selected by the customer in the case of a connection with ZVT (this is not the case with a Nexus connection such as with Hypersoft Pay powered by Adyen). To counteract the ZVT DCC problem, the cash register manufacturer can send your national currency with each payment (for security). This then requires some kind of "initialisation", which does not work as standard with all devices and firmware versions. Therefore, we would like to support DCC only with partner companies and after coordination or testing of the devices used.

Settle transaction without amount

A transaction without an amount (e.g. only pre-order cancellations) cannot be completed as a cashless transaction (at 0,-). Such a request is automatically completed by the system to BAR.

Set operator permissions and reports

Depending on the workflow, the following settings for operator permissions and operator reports, for example, may be useful for you:

Block payment types for operators individually...

Technical description of the card IDs and internal handling

Link to the currency table ...

| Card ID Adyen |

Card ID Wallee |

Card ID ZVT |

KKDEF-ID |

Hypersoft ID Currency table |

Hypersoft designation |

|---|---|---|---|---|---|

|

mc |

A0000000041010 |

6 |

6 |

26 |

Mastercard |

|

A0000001570020 |

6 |

6 |

26 |

Mastercard |

|

|

mccredit |

6 |

26 |

Mastercard |

||

|

mcstandardcredit |

6 |

26 |

Mastercard |

||

|

mcstandarddebit |

200 |

16 |

36 |

MC debit |

|

|

mccommercialcredit |

6 |

26 |

Mastercard |

||

|

mccommercialdebit |

16 |

36 |

Mastercard |

||

|

mcsuperpremiumcredit |

6 |

26 |

Mastercard |

||

|

mcsuperpremiumdebit |

16 |

36 |

MC debit |

||

|

mccorporate |

6 |

26 |

Mastercard |

||

|

mccorporatecredit |

6 |

26 |

Mastercard |

||

|

mccorporatedebit |

16 |

36 |

MC Debit |

||

|

mcfleetcredit |

6 |

26 |

Mastercard |

||

|

mcfleetdebit |

16 |

36 |

MC Debit |

||

|

mcpro |

6 |

26 |

Mastercard |

||

|

mcpurchasingcredit |

6 |

26 |

Mastercard |

||

|

mcpurchasingdebit |

16 |

36 |

MC Debit |

||

|

visa |

A0000000031010 |

10, 11 |

5 |

25 |

VISA |

|

A0000000032010 |

10, 11 |

5 |

25 |

VISA |

|

|

A0000001570030 |

10, 11 |

5 |

25 |

VISA |

|

|

visacredit |

5 |

25 |

VISA |

||

|

visadebit |

40 |

15 |

35 |

Visa Debit |

|

|

visacommercialcredit |

5 |

25 |

VISA |

||

|

visastandardcredit |

5 |

25 |

VISA |

||

|

visastandarddebit |

15 |

35 |

Visa Debit |

||

|

visacommercialdebit |

15 |

35 |

Visa Debit |

||

|

visacommercialpremiumcredit |

5 |

25 |

VISA |

||

|

visacommercialpremiumdebit |

15 |

35 |

Visa Debit |

||

|

visacommercialsuperpremiumcredit |

5 |

25 |

VISA |

||

|

visacommercialsuperpremiumdebit |

15 |

35 |

Visa Debit |

||

|

visasuperpremiumcredit |

5 |

25 |

VISA |

||

|

visasuperpremiumdebit |

15 |

35 |

Visa Debit |

||

|

visabusiness |

5 |

25 |

VISA |

||

|

visaclassic |

5 |

25 |

VISA |

||

|

visacorporate |

5 |

25 |

VISA |

||

|

visacorporatecredit |

5 |

25 |

VISA |

||

|

visacorporatedebit |

15 |

35 |

Visa Debit |

||

|

visadankort |

5 |

25 |

VISA |

||

|

visafleetcredit |

5 |

25 |

VISA |

||

|

visafleetdebit |

15 |

35 |

Visa Debit |

||

|

visagold |

5 |

25 |

VISA |

||

|

visaplatin |

5 |

25 |

VISA |

||

|

visapremium |

5 |

25 |

VISA |

||

|

visapremiumcredit |

5 |

25 |

VISA |

||

|

visapremiumdebit |

15 |

35 |

Visa Debit |

||

|

visaproprietary |

5 |

25 |

VISA |

||

|

visapurchasing |

5 |

25 |

VISA |

||

|

visapurchasingcredit |

5 |

25 |

VISA |

||

|

visapurchasingdebit |

15 |

35 |

Visa Debit |

||

|

electron |

5 |

25 |

VISA |

||

|

amex |

A00000002501 |

8 |

8 |

28 |

AMEX |

|

A0000001570010 |

8 |

8 |

28 |

AMEX |

|

|

amexstandarddebit |

8 |

28 |

AMEX |

||

|

amexconsumer |

8 |

28 |

AMEX |

||

|

amexcorporate |

8 |

28 |

AMEX |

||

|

amexsmallbusiness |

8 |

28 |

AMEX |

||

|

amexdebit |

8 |

28 |

AMEX |

||

|

cup |

A0000001574460 |

198 |

49 |

69 |

China Union Pay |

|

diners |

A0000001523010 |

12, 232 |

7 |

27 |

Diners |

|

A0000001574443 |

12, 232 |

7 |

27 |

Diners |

|

|

dinersstandarddebit |

7 |

27 |

Diners |

||

|

jcb |

A0000001570040 |

14 |

9 |

29 |

JCB |

|

jcbstandarddebit |

9 |

29 |

JCB |

||

|

vpay |

A0000000032020 |

13 |

18 |

38 |

Vpay |

|

vpaystandarddebit |

18 |

38 |

VPay |

||

|

maestro |

A0000001570022 |

92 |

42 |

62 |

Maestro CH |

|

A0000000043060 |

17 |

17 |

37 |

Maestro |

|

|

A0000001570021 |

17 |

17 |

37 |

Maestro |

|

|

maestrostandarddebit |

17 |

37 |

Maestro |

||

|

maestrouk |

17 |

37 |

Maestro |

||

|

Girocard |

5 |

2 |

22 |

ec International |

|

|

girocard |

5 |

2 |

22 |

ec International |

|

|

alipay |

50 |

70 |

AliPay |

||

|

alipay_wap |

50 |

70 |

AliPay |

||

|

alipay_hk |

50 |

70 |

AliPay |

||

|

alipay_sg_pos |

50 |

70 |

AliPay |

||

|

|

51 |

71 |

|

||

|

wechatpay |

51 |

71 |

|

||

|

wechatpay_pos |

51 |

71 |

|

||

| 79 | New API Partner | ||||

|

A0000001110101 |

69 |

19 |

29 |

TWINT |

|

|

A0000001570051 |

69 |

19 |

29 |

TWINT |

|

|

A0000157449E |

82 |

33 |

53 |

TWINT |

|

|

9 |

1 |

21 |

ec National |

||

|

38 |

10 |

30 |

Breuninger |

||

|

42 |

11 |

31 |

ec Cash |

||

|

76 |

14 |

34 |

IKEA Fam. Kart |

||

|

85 |

12 |

32 |

Other credit cards |

||

|

201 |

40 |

60 |

Lunch Card |

||

|

83 |

41 |

61 |

Lunch-Check Card |

||

|

57 |

43 |

63 |

Power Card |

||

|

251 |

44 |

64 |

Loeb |

||

|

252 |

45 |

65 |

Manorcard |

||

|

253 |

46 |

66 |

WIRcard |

||

|

15 |

47 |

67 |

Reka |

||

|

148 |

48 |

68 |

Giftcard |

||

|

400 |

-19 |

1 |

Innocard TZ Bar |

||

Back to the overarching topic: Hypersoft Pay powered by Adyen