Value added tax Adjustments

Germany: Planned VAT changeover on 1 January 2026

Initial legal situation

From 1 January 2026, food served in gastronomic establishments or in communal catering - for example in restaurants, cafés, food trucks, catering establishments as well as in schools, daycare centres and hospitals - will be permanently subject to the reduced tax rate of 7%.

The fact that drinks are predominantly taxed at 19% remains unchanged. Exceptions continue to apply for milk and mixed milk drinks with at least 75% milk content and for tap water outside the home, which may be labelled with 7%. Plant-based milk alternatives are excluded from this.

Our notes on the changeover to Hypersoft

At this point, we will inform you about the technical possibilities for correct and timely implementation in Hypersoft.

Current status

The tax adjustment is made manually for each item. Optionally, you can also adjust the sales prices.

Regardless of the individual settings, we recommend the following standard procedure:

Three steps to a successful VAT changeover from January 2026

1. Prepare article master

-

Deactivate the automatic article master data update in advance.

-

Filter the articles to be changed in the article master.

-

For extensive adjustments, use the table editing function to conveniently check and change VAT rates.

2. Apply adjustments on time

-

Make sure that operators can only update with the appropriate manager authorisations.

-

Update the article master between the last daily closing 2025 (also valid after 00:00) and the first posting on 1 January 2026.

-

Check your end buttons for in-house and external functions.

-

Restart all systems as soon as the changes have been applied.

3. Checking receipts and reports

-

Check the correct VAT allocation for all items (7 % and 19 %).

-

Check the relevant reports and invoices after the restart.

Important note

The tax valuation of individual items is your responsibility and cannot be taken over by Hypersoft support.

We will be at your disposal as best we can, but will have to prioritise serious incidents in the week before and after the changeover. General enquiries about the VAT changeover have a lower priority during this time.

If the changeover cannot be realised exactly in time, the following applies:

Switching too late is less critical than switching too early, as higher taxation does not cause any tax disadvantages.

Preparation in various system structures

Individual systems

You can prepare the article master completely and only activate the update when you want to change over.

Please note: If the article master is blocked, the cash registers do not update automatically. The release or manual update at each cash register is mandatory.

Systems with control centre and web clearing

Stop the master data synchronisation, prepare the changes and restart the synchronisation at the desired time.

In large systems with price groups, the scheduled VAT changeover is available to you.

Head office with several locations

Check and change the articles per client in the central article master.

Then distribute the changes to the locations automatically or manually via web clearing.

Use centralised or location-based article masters depending on how you work.

Technical centrepiece

Regardless of your system architecture:

-

The VAT setting for each item must be checked and adjusted if necessary.

-

A complete system restart is required after each customisation.

-

In the case of centralised/branch systems, changes must be synchronised correctly for each location.

Further topics:

Master data adjustment in stores to START/STOP

Start web clearing in the branch.

Edit individual articles

Log in to the Master Control Panel, go to APPS - POS - Item Master and adjust the settings:

General information on the change in the VAT level

Please always be aware of the legal basis before you adjust your VAT settings. We recommend that you always check the master data with regard to all important parameters when commissioning the POS system, in case of changes by your or our employees. The report POS item with the master data of the item master is suitable for this purpose.

If in doubt, ask your tax advisor or choose 19%. Please understand that we cannot make these decisions for you and therefore in this case we would like to provide only limited assistance by support. You and your tax advisor are responsible for this.

When making quick mass changes, please check whether the discounted VAT rate really applies to all selected items and correct any errors before booking the items.

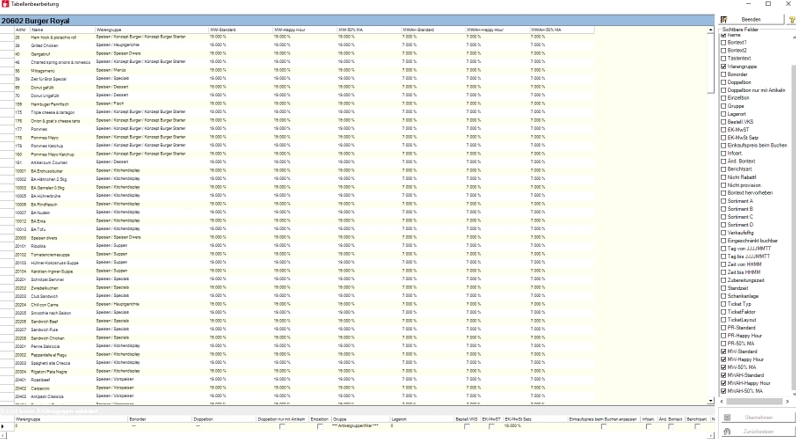

To adjust the sales tax for many items, use the table editing function in the item master. The editing of the VAT can be done comfortably and easily via the table editing. In order to be able to adjust main groups or material groups specifically, you first filter them.

Simply select the main group or product group and press FilterNow .

You can tell by the ! in the item search bar that the filter is active.

In the item master dialog, press Tablein the upper right corner.

Now mark all items. To do this, click on the first line at the top left (before the article number - in the image) and then select the last line while holding down the Shift key. Look at the marker:

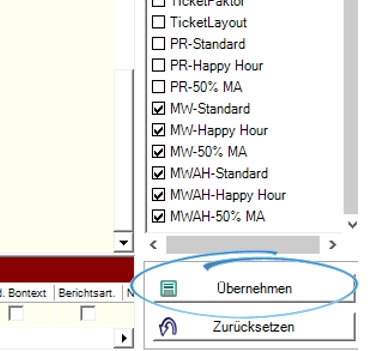

Now select the VAT. for the corresponding price level. Note that there are two entries per price level (In house & Out house).

Then press Accept.

Now confirm your changes in the item master with the button Save.

Your cash register will then update the new data.

If necessary, note the release of the item master for POS: Processing during operation

Check closing keys / invoice keys

The Hypersoft POS system offers many options for creating invoice keys that are particularly practical for optimised use. As until 31.12.23 the VAT rate was rate for out-of-home and in-home bookings is identical, it could lead to errors when using the Hypersoft POS system in the future because the service staff, for example, have also used the former out-of-home invoice button for in-home bookings. Please check your invoicing procedure for inbound and outbound bookings. Below are two invoices of what it should look like after the changeover.

Once the synchronisation has been completed, you can check whether the VAT increase has been applied in the webshop / shopping cart during checkout.

Simply book the corresponding items in the shopping basket and then check this view:

Head office with locations

For headquarters with locations, the above information applies. Please make sure that you also make the settings for the master client. Since there is usually no cash register system running there, depending on the configuration, it may not be possible to adjust the VAT levels automatically. It would be fatal if the locations change over correctly and then receive outdated or incorrect data via web clearing.

In this context, also pay attention to the use of price groups that may already have been created and have a timer after the changeover. Check that there are no future timers at the time of the changeover and re-create existing ones with the new VAT settings if necessary.

You can set the master data synchronisation of the locations to STOP in the central web clearing configuration to prevent premature transfer. This setting must then be set back to Start in good time. You see Webclearing Central Settings.

If you work with price groups, you also have the option of editing the VAT there.

FAQ section on the VAT changeover

Customise TTA...

-

The /TTA is set to 06:00 as standard, but may have been set differently for you. If you are expecting longer working hours on New Year's Eve, adjust the TTA in the country settings section beforehand.

VAT changeover missed or failed...

-

If you do not manage to convert the VAT correctly in time, you can manually convert your final report to 19% VAT. convert, document accordingly and agree with your tax advisor.

In house and out of house bookings differ...

-

Since the VAT. is currently identical, you can still evaluate the in-house and out-of-house bookings accordingly with various Hypersoft reports from the Report Manager. Hypersoft recommends the categoriesreport here, please note the corresponding option buttons.

Customise account assignments and export (optional)

To see the text, click here.

The changes in VAT may also affect your export to accounting programs such as DATEV.

Please bear in mind that the account assignment can still be changed until the export in the following month. If you have any questions, it might be better to wait for a quiet time and postpone the change to a later date.

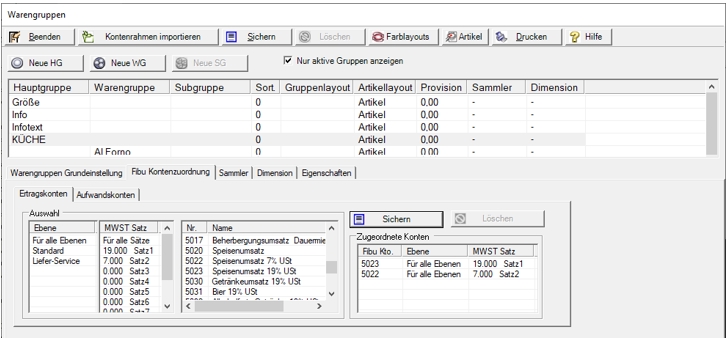

Technical notes on the account assignment of the material group turnovers (revenue account) divided into VAT:

You can create additional accounts for bookkeeping in order to better differentiate between the 19% / 7% or 16% / 5% accounts. In the example you see 5023 and 5022 for the food turnover 19% and 7%. After transferring the sales with the existing account assignments to DATEV, the account assignment in the product groups must then be changed before the sales are transferred to DATEV.

Back to the overarching topic: Basic knowledge 3: Special knowledge