Things to note about Hypersoft Pay (Adyen)

Introduction

Hypersoft Pay powered by Adyen can be used both in the eSolutions area and with stationary terminals. In addition to the advantages of a single point of contact and standardised billing of all payments, the transparency and uniformity of the fees are particularly impressive. Hypersoft acts as the primary technical and contractual contact. While the fees for stationary terminals are highly competitive throughout Europe, eSolutions fees are often significantly higher. This poses a challenge for many companies: a favourable girocard fee is of little use if customers are increasingly paying with Apple or Google Pay, which is processed via credit cards (or credit card features of debit cards). These debit credit cards lead to higher fees, which can be a disadvantage for five-year contracts.

-

Your contracts should take into account both the fee structure for eSolutions and the growing proportion of credit card payments. Digital payment receipts, the transfer of bonus points, vouchers and loyalty programmes via smartphone are increasingly expected. Industry leaders are setting the standard here, and without a reliable partner and the right technology, your company could be left behind in the digital transformation. Outdated five-year contracts could be a double burden.

-

The digital transformation in the payment sector requires flexible and future-orientated technologies. Quickly available solutions, such as registering with a delivery service platform or buying cheap terminals online, seem tempting, but they often do not involve well thought-out workflows or seamlessly integrated processes. Separate systems for POS and payment lead to problems such as incorrect prices, unavailable orders and unclear processes. Firstly, internal accounting suffers, and later a tax audit could lead to financial disadvantages (e.g. unallocable payments, loss of tax exemption for tips).

A sound understanding of all conditions and their integration into holistic processes is crucial for your long-term, secure success.

Adyen provides best practice guide

Adyen offers you as a customer a detailed guide to familiarise yourself with the basics of payment processing. The guide covers topics such as accessing the account, setting up multi-factor authentication, managing payments, refunds and fraud prevention. It also explains how to configure account settings, carry out regular risk assessments and reconcile invoices. The information is specially prepared for you as a customer and offers step-by-step instructions to simplify payment management.

A note on the Adyen wording:

For Adyen, you as a customer are an "Adyen franchisee"; if you yourself are a franchisor or franchisee in connection with the catering industry, the term has a different meaning for you at Adyen.

For more details, you can find the guide here (translation as always possible with browser tools): https://help.adyen.com/guides/franchisees-basics-guide

Communication security between Adyen and Hypersoft

With Hypersoft Pay powered by Adyen, you enjoy the highest level of communication security for mobile payments. If a payment terminal stops responding to POS requests during the payment process (which can happen occasionally), the cloud engine of the location system asks the Adyen server for the final status of the transaction. Depending on the response from the acquirer server, the process is either cancelled or recorded as successful. The tip is then split and the process is finalised. It remains visible as a "blue table" until completion. This takes place immediately after the specified waiting time (time out), during which the system waits for a response from the terminal.

Further topics: Internet connection of the Hypersoft system...

Special feature for multiple payments...

See this: Special feature for cashless multiple payments...

Important information about the firewall configuration for Adyen payment terminals

You must update your firewall configuration so that terminals can access *.cdn.adyen.com via your network and thus ensure smooth processing of personal payments with terminals. To do this, you can follow the steps described on this special Adyen help page.

Additional information on network recommendations for payment terminals can be found here.

Resources:

Documentation: Network configuration → General network recommendations

Further topics: 2. card payment and special authorisations

Questions about accounting and bookkeeping

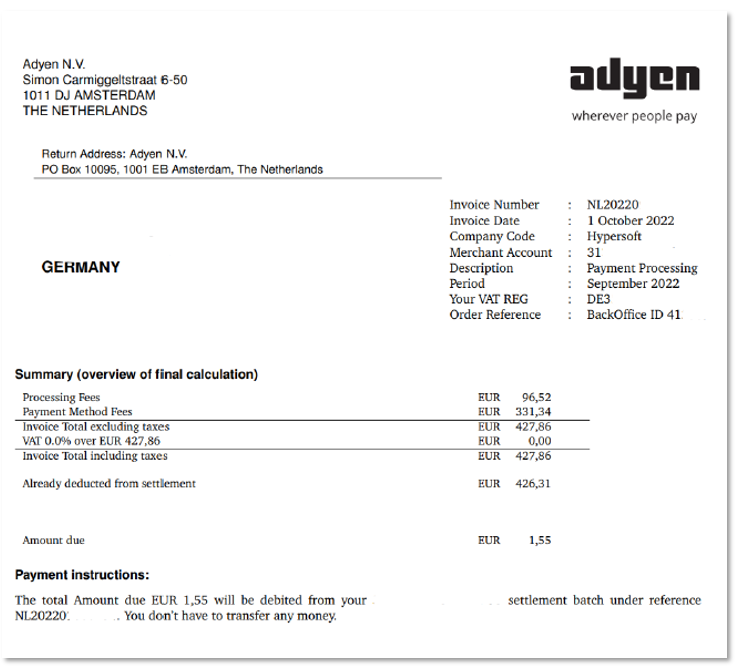

In the standard version, you will receive the statements from Adyen by email to the address that you entered during onboarding with Adyen. This statement is in English, but since the terms used in cashless payments are mostly in English anyway, it is easy to understand. For further settlement requirements, we recommend using the Adyen online portal (which can also be set to German) and have also created several help topics on settlement:

Billing by mail...

As standard, you will receive the statement once a month from Adyen by email to the address you provided during onboarding.

The statement is in English. If you use Adyen's portal, you can change a lot of things to German, but the billing table remains English. Our partner Adyen has described the best procedure for reconciling your invoice at this link: https://docs.adyen.com/reporting/invoice-reconciliation

Some direct translations:

| English | German |

|---|---|

| Return Address | Sender |

| Invoice Number | invoice number |

| Invoice Date | invoice date |

| Merchant Account | Internal number (Hypersoft at Adyen) |

| Description: Payment Processing | Invoice type: Payment execution |

| Period | period |

| Your VAT Reg | internal |

| Order Reference | internal |

| Processing fees | Processing fees |

| Payment Method Fees | Payment methods fee |

| Refund Fees | Fee for reversal / chargeback of a payment |

| Invoice Total excluding taxes | Net total of the invoice |

| Already deducted from settlement | Already deducted from the settlement. (Adyen had already retained this partial amount). |

| Amount due | Amount due (The invoice amount minus the amount withheld). |

| Payment Instructuions | Terms of payment |

| The total amount due EUR xy,- will be debited from your settlement batch under reference NL...... You don't have to transfer any money. | The total amount due of xy,- EUR will be debited from your bank account Use reference NL...... debited. You do not need to transfer any money. |

Hypersoft Pay Powered by Adyen as PayPOS

You can combine Adyen payment terminals with the Hypersoft mPOS mobile POS system so that you only need one device for both tasks. You can find an overview of the units at .

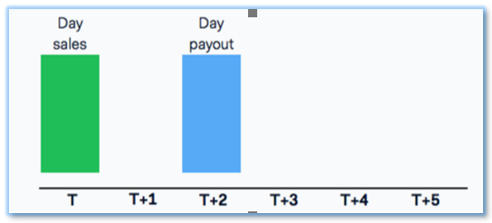

If you accept cashless payments, your money should reach you as quickly as possible. Depending on the provider, this can take longer or cause considerable costs due to individual bookings on your business account.

Our Adyen computer centre collects the payments, provides you with an easy-to-understand statement and usually transfers the money on the second day.

Example: All payments received on Monday are paid out collectively on Wednesday.

This service usually costs up to several cents per transaction, depending on the provider. With Hypersoft Pay powered by Adyen, this is already included.

You should know that, like almost all data centres, Adyen also retains certain partial amounts for a temporary risk period when making risk payments. This is decided by the Adyen algorithm as required and shown accordingly on your statement. This also protects you from most short-term return claims. We would like to mention this, even though this is not usually the case when paying in the catering trade. See also Adjustments / Changes in the Sales to Payout / Payouts Report in the Hypersoft Pay Portal.

Simple or favourable pricing models and discounts

In fact, the costs of cashless payments are difficult to track. Here, one comes across two different models again and again. The so-called"blended model" calculates an average of the expected costs, calculates risks of the data centre at your expense and then gives you, for example, a discount price of 1.8% on most credit cards. That is easy to understand.

In fact, credit cards have very different discounts and within the issuers, such as Mastercard, a distinction is made at least between domestic and foreign cards, and in each case on the basis of the corporate card option. Since Hypersoft customers work in the professional sector, we have decided against Blendet models as standard and calculated after the first year with Hypersoft Pay powered by Adyen that this gives you approx. 0.5% more of your cashless turnover at your disposal with credit cards. For this, we ask you to consider the differentiated settlements as positive. You can easily control these with the Hypersoft Pay Accounting Report, see also the chapter Control of Payment Method Fees......

Amount window through minimum and maximum

For payment, there is a minimum and a maximum that you can (partly) set in the Adyen portal or that can be set for you. Independently of this, such settings can also be made with other payment service providers. We therefore recommend that you take a look at this topic, which we deal with in the section Hypersoft Pay Amount Window, and adjust it carefully for yourself.

3D-Secure 2 - A new authentication solution

If you've made a purchase online in the last ten years, you've probably had to deal with 3DS1 when you were redirected to an often rather unappealingly designed page from your bank to confirm your identity.

3DS2 is the new standard and replaces the previous first level.

Much more than just a redirect, 3DS2 can be used as a tool for sharing meaningful data between merchants and banks through the combination of certified SDKs in the checkout flow as well as data sharing APIs. More than 100 potential data points are shared with issuing banks. This way, the information you and your card issuer have about your mutual customers can be used to make better risk decisions. The more information you have to decide authentication cases, the higher the probability of authorisation - and that benefits you. With 3DS2, data can be exchanged silently in the background between banks and merchants. In this way, authorisation rates can be increased without any noticeable changes to the check-out flow for the customer.

The new 3D Secure transactions generate fees of around 5 cents, depending on the data centre. With Hypersoft Pay powered by Adyen, there are no extra fees for you, even for 3D Secure transactions.

Klarna or Sofortüberweisung in case of cancellation

If there is a problem with the payment via Klarna or Sofortüberweisung, whereby the payment is made but the forwarding to the Shop(APP)/ NoCOO is cancelled so that the order cannot be processed, an automatic cancellation will take place after 5 minutes. With Adyen, the payment is blocked accordingly for the cancellation (refund).

Due to the internal processes on the part of Adyen and Klarna or Sofortüberweisung, the chargeback of the amount can take up to 72 hours.

Integrated SIM card for unlimited use

Note that due to the weak antenna performance of the Verifone payment devices, we are currently looking for an alternative for the SIM operation of these devices. During this time, please refrain from sales and installations unless you are using them in a very high quality reception area.

Offline operation (for credit cards)

Under certain circumstances, credit cards are sometimes accepted without being checked ("offline"). We do not support this procedure with Hypersoft Pay powered by Adyen.

The terminals and also the eSolutions transactions always check the current payments online for your security.

PayPOS pre-installed on Adyen terminals

The PayPOS variant of the mPOS Client Server is pre-installed on Adyen Android payment terminals and is also updated there if required. The programme is activated at your request via licensing. Otherwise, you can ignore the programme.

After starting the app (even without a licence), you will be asked for permission to use the camera and to use files; these permissions are needed to use the internal camera as a QR code and barcode scanner and to write the configuration files. This permission must be granted if you have licensed and want to use the mPOS Client.

Further topics: Noteworthy information about mPOS Client-Server

Language of customers and trader receipts

Sometimes you wonder why, for example, the dealer receipt is in German and the customer receipt is in English. This is due to the fact that the merchant receipt is printed in the language set in the back end at Adyen and the customer receipt is printed in the language read from the credit card.

-

Merchant receipt in the language set in the Adyen portal

-

German credit card = German customer receipt

-

English credit card = English customer receipt

Easy payment at the POS...

-

The POS system sends a payment to the BZV Adyen client.

-

The client forwards the payment to the terminal

-

The terminal communicates the payment with the Adyen portal

-

The terminal sends the result of the payment to the client

-

The client transfers the result to the POS system

Pay@Table Payment...

-

The terminal sends the Pay@Table request to the BZVReceiver

-

The BZVReceiver checks the request and sends it to the corresponding client.

-

The client sends the table list to the terminal and waits for the table to be selected

-

After the table selection, the client sends the payment to a subsystem

-

The subsystem transfers the invoice document to the client

-

The client transfers the invoice receipt to the terminal for printing and initiates payment

-

The terminal communicates the payment with the Adyen portal

-

The terminal sends the result of the payment to the client

-

In the case of a partial payment, the next payment is transferred to the terminal

-

After all payments have been completed or cancelled, the result is transferred to the POS system.

evaluations

Cashless payments are analysed in the Hypersoft reports as standard. In the Payment method and type detailed report, you even receive a link from the customer payment analysis directly to the Adyen portal.

Data transfer to law enforcement authorities (Adyen)

In certain situations, it may be necessary for Adyen to disclose data at the request of law enforcement authorities or government agencies. This process is subject to a clearly defined legal framework and follows international data protection guidelines as well as the applicable law in the countries concerned.

When is data disclosed?

Adyen may be obliged to disclose data if there is an official request from an authorised government agency. Such requests must be valid and enforceable under the applicable laws - for example, in the form of a court order, a subpoena or a comparable administrative order.

Which data is affected?

The disclosure may concern personal data, transaction data, account information or other business-relevant information, insofar as this is necessary to fulfil the request.

How does Adyen protect your data?

Adyen checks every enquiry carefully and only passes on the minimum required information. It is ensured that:

• the request comes from an authorised authority,

• the information requested is appropriate and necessary,

• data protection is also safeguarded in the context of disclosure.

Further information from Adyen

You can find a detailed explanation of how to handle such data requests directly on the Adyen website:

Hint:

Hypersoft itself has no direct influence on these processes and generally receives no detailed information about such requests or their content. If you have any questions about the handling of data transfers by Adyen, you can contact Adyen support directly or obtain information via the page linked above.

Back to the overarching topic: Hypersoft Pay powered by Adyen