Noteworthy aspects of the cashless area

Components of a cashless area

In a cashless area, a POS system has very specific components:

- A check in point at which a card is issued to all customers.

- Cash terminals that do not cash, but post to the card.

- A Check Out checkout where the cards are settled.

All cash registers in a cashless area are equipped with card readers. The money is collected centrally at one (optionally several) checkout desks.

Controlling in the cashless area

It can be a fallacy to have to control a cashless checkout system less. Although only a few staff members are directly involved with the settlement of the cards, the booking on the cards can happen quickly and also unintentionally inaccurately. We recommend that you use the available settings and train staff to book safely on cards (and not "next to them"). Please also consider that you should create opportunities for the operators in the cashless area to continue to receive tips .

Keep in mind that people use cards with the same technology for other purposes and may therefore be in possession of cards that could be used in your system. You should therefore have the reader supervised by an operator when the function is activated and the login is active (four-eyes principle), so that no third-party cards can be activated and used for ordering (for payment, you then only take the one issued by you). If possible, use the whitelist so that cards are deactivated after payment.

You must assume that customers will lose their cards - or at least that they will not be found again until they leave the cashless area. The customer must be given the opportunity to leave the area without a card.

In order to determine the value in dispute, the card is provided with a limit, so that in the event of loss of the card, the limit (and the value of the card itself) can be claimed instead. Of course it is up to you to make other decisions in individual cases.

You can also use Club Check-In to capture photos of customers at check-in so that you can quickly block lost cards. In addition, the image display prevents misuse during checkout.

In order to be able to settle lost transaction cards anyway, you can search for bookings in the POS system in order to possibly find the transaction.

Daily accrual of the options

The features admission price, credit balance + minimum consumption are only applied once per opening day. This allows customers with assigned card properties to check in multiple times on the same day.

In terms of card management, there is a whitelist and a blacklist. A blacklist is a list of cards that should no longer be used. A whitelist ensures that no more cards than those defined there can be used (unless they are also on the blacklist). A whitelist makes sense:

-

Without a whitelist, your customers could use randomly compatible cards, for example from a car park, and thus mess up your closed loop system. For this purpose, it is sufficient to use a permanent whitelist.

-

The use of a temporary whitelist always activates the cards only currently for their use and deactivates them together with the settlement. This avoids having to watch out for cards with credit value, because these have either just been handed out to customers or they are, so to speak, "deactivated" (as they are not in whitelist) ready to be issued. With the output, these are entered in the whitelist. This procedure can be used in both Club Check-In and Easy Check-In.

The use of a whitelist is a option in card management.

You can set a cashier terminal that is used as an entrance ticket in the settings for each cashier station so that it automatically enters the card in the whitelist when it is read.

To use data carriers for payment system (largely secure), you can enter each card in the whitelist and set the system to check the cards for validity. You make the setting for checking the whitelist with the switch Check validity of cards in the Card Management programme. In addition, we recommend that you have automatically remove any cards remaining in the whitelist at the end of the day.

Cards are issued differently depending on whether you use Club Check-In or Easy Check-In.

Unwanted compatible cards when working with the whitelist

If you reuse the whitelist daily as recommended and do not assign valid cards once, it may happen that foreign cards are entered if your employees allow this. If any bank card or parking card or other card is technically compatible, its number can be read and entered into the whitelist. The card can then be used. Since this is usually not desirable, point this out to your employees and strictly prohibit the use of cards other than your own (which should go without saying).

If you don't want this, use the whitelist once, but then you have to pay special attention to the credit amount that each ready valid card carries.

Cash register function and parameters for whitelist

If you do not want to whitelist the cards using theActivate transaction cards automaticallyfunction, you can use theActivate MP customer card checkout function.

You can also start the cash register function Activate customer card with a macro so that the card is entered in the whitelist with a set value.

This macro adds a card limit of 50,- and a minimum consumption of 5,- to the whitelist:

50,5 + MP customer card activation

Activate 50 + MP customer card

You can initializethe card as an operator card.

Further topics: Activate operator cards

Remove or block cards from the whitelist

There are several ways to remove cards from the whitelist. First of all, you should determine whether cards need to be reactivated after a single use or not. To remove the cards from the whitelist after one-time use, add the checkout function Deactivate MP cardto all end keys in checkout mode. As soon as this card is used for payment, it is removed from the whitelist.

The next decision is whether you want to reuse the tickets after a close of the day without reactivating them, or whether you want to remove the tickets all together from the whitelist during the close of the day. To remove all cards from the whitelist at day-end closing, use the Reset whitelist at day-end closing system button in the global area of the stationsetting.

Now we come to the tickets that were not paid for at the end of the day. You can block such cards manually or during automatic day-end closing. For the automatic variant, activate the option switch Lock MP customer cards in the settings of the Automatedaily closing program.

For the manual variant, use the cash register function MP Block customer card in a function macro that you activate before the day-end closing. All still open processes, which for example result from lost cards, are blocked by this. The cards are entered in the so-called blacklist and the postings of the open transactions are transferred as losses. Example:

- Block MP customer card

- Form (e.g. invoice)

- Reason for loss (e.g. loss of card)

- Payment type (for example, main currency)

When a blocked card is scanned later, the operator is notified at the POS system that he should use this card to report to the manager. If the card is then scanned again in cashier mode by an operator with manager status, the date, amount and card number are also displayed. With this customer or card number you can find the receipts of the blocked cards again and settle them afterwards.

Only the transaction card type is taken into account. If the card has been assigned a price or loss level, a discount rate or the status personnel card, this function does not remove the card from the whitelist. You have to delete such cards differently. Only cards that are entered in the whitelist will be blocked. Unactivated (unused) cards will not be blocked.

If you use the block MP customer card function, you must protect yourself from accidentally triggering it on other cards, otherwise their open transactions can no longer be settled. If necessary, use a separate layout of the keyboard programming for this purpose.

Admission for Easy Check-In...

Via a MixMatch setting, entry can optionally be booked automatically. If you use different admission prices, you can offer these to the selection by an item with forced inquiry. The most expensive entry should be deposited in the item and only by the inquiries then the price should be reduced. In this way, you largely ensure that the entry is booked.

Further topics: Configure card management

Admission for Club Check-In...

The Club Check-In area has a dedicated area in the ticket management to define numerous different tickets.

End of day with Easy Check-In and lost cards

If transactions have not been settled at the end of the day, the daily closing cannot be carried out. You can automate the Automate close automate this situation and close the operations.

Open processes for operator accounting...

The first operator to open a process is given process responsibility (standard in the Hypersoft system). If there are now open processes, the operator cannot settle (for example with Wallet-Control). To do this, you can use the Change Operator (or Manager Operator Change) function, where all open operations are listed and can be transferred to another operator. If necessary, you must create a virtual operator (for the last operator) who takes over the responsibility for the operation.

You can define minimum consumption with the Club Check-In. A minimum consumption specifies the minimum turnover that a customer must make. If this minimum consumption is not reached, the amount must still be paid until the minimum consumption is reached.

Step-by-step approach:

- In the item master, set up a base item (without price) that is to be posted automatically with the missing minimum consumption.

- In card management, assign this item as an item for the minimum consumption clearing posting.

- Activate Checkcard validity in card management.

- When you later activate the cards for the whitelist, you specify the minimum consumption.

- When transactions are posted to this card, the minimum consumption is reached. If the minimum consumption is not reached and the card is closed, the system automatically posts the missing amount. Both the CLOU and the CLOU Mobile.

Minimum consumption in cashier mode....

If cards with minimum consumption are used in cashier mode, the amount for the minimum consumption is displayed, e.g. 5,- MINfor 5,- minimum consumption. Also on the CLOU Mobile. This information only expires when the minimum consumption has been completely achieved through sales.

Minimum consumption for couples or groups...

If couples or groups consume together, it can happen that individual cards have not reached the minimum consumption, although there is sufficient turnover in the sum. To avoid having to calculate an unauthorized minimum consumption, use the Mergecards function during settlement. The total turnover and the total minimum consumption are then compared and invoiced.

Expenses and tips have no effect on the minimum consumption and are not included in its calculation.

Merge or separate processes or cards

At aCheck Out Station, you can activate the alternative Merge Operations, which automatically merges several customer cards at Check Out.

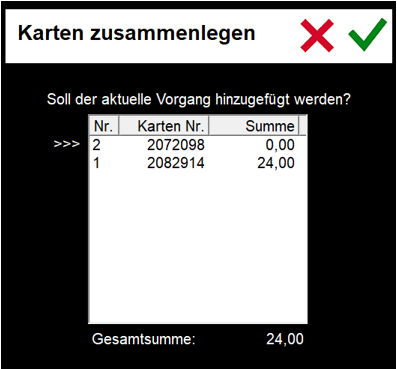

If you scan in a customer card and then another one, without having completed the process, you will be asked whether the sales should be combined.

The number of customers is taken into account here by using it from all the merged cards. The number of customers is valuable information in evaluations, e.g. for the average check / average turnover. In this context, also make sure to fold unused cards in this way instead of simply not charging them.

By merging, the previously valid card limit can be exceeded by activating Ignore card limit.

Form with folded cards:

Since the card number is unique for transaction cards, it is displayed here in order to be able to clarify any queries.

Settle several clients or cards in one invoice with Accounting

If you wish to transfer one or more cards to a customer in order to settle these bookings via customer account (MPA), then first read in the customer transaction to which you wish to settle and then scan the other cards one after the other. With each scan, you will be asked if the operations should be merged. If you answer yes, the bookings are transferred to the first customer (the first card). All bookings are settled with the closing of the On Client Account (MPA) and thus transferred to Accounting.

Without the option Merge processes, a disconnection of the active card takes place automatically at the stations if another card is read in during a process that is still open. The operator can read in a new card without first having to press a close key if he is still in the data of another card (process list is still open).

When this method is used, the first key (column 1 from top to bottom, then column 2, etc.) with the cash register function Key out is applied when the new card is read in and a function macro present there is executed. If Keyout is not available on the keyboard, the cash register functions Print Bonorder and New balance are executed. If the cash register function Operator logout is available on this key but logout is undesired during disconnection, this logout can be skipped with the switch Operator do not log out.

In the ward administration, you must globally set the map system used for the entire system. Then settings are made for each cash register station.

Further topics:

The transponder reader must be connected to each cash register station. This is done by setting the station details in the register Peripherals.

| Element / Switch | Function / Description |

|---|---|

| Do not log off operator | Further topics: Automatic card disconnect... |

| Quick Check-In Ordercard | See the section Easy Check-In Options |

| merge operations | Merge Operations is a function that merges multiple cards at the Check Out counter for joint payments. See . |

| Activate transaction cards automatically |

The function Automatically activate process cards activates cards when they are read with the card reader and opens the corresponding process. |

| Ignore card limit | If you generally combine cards at this station, you should allow the card limit to be exceeded here by activating Ignore card limit. |

| Card limit | Here you can set the card limit for cards issued with the Easy Check-In procedure. With Club Check-In, the credit amount per card is stored as Limit in the card management. |

Back to the overarching topic: The cashless area